The financial year that ended in June 2021 has been an interesting ride to say the least. In this note we take you on a journey where we first look at asset class returns over this period, summarise some of the key themes that have been driving returns, followed by a top down view from the high road of important trends to be aware of from here. We conclude with Alphinity’s current positioning as we embark on the winding path of a new financial year.

At Alphinity we look for quality companies in an earnings upgrade cycle available to purchase at reasonable valuations. We find these opportunities by applying our agile, bottom-up driven investment process, which combines fundamental, quantitative and ESG research. We let earnings leadership guide us through cycles, whilst being aware of the global macro framework in which we are investing.

FY21 – In the rear-view mirror

The global economic recovery has gained momentum since the COVID recession lows of April 2020, with consensus expectations forecasting global GDP growth for CY 2021 at 6.1% and 4.4% for CY 2022. Both Global Manufacturing- and Services PMI’s have rebounded strongly to well above pre-COVID levels. Financial markets have responded with a vengeance, with cyclical assets, such as commodities leading the charge, up nearly +57% from their COVID Crisis lows. Global equity markets have outperformed other major asset classes such as fixed income, credit and real estate.

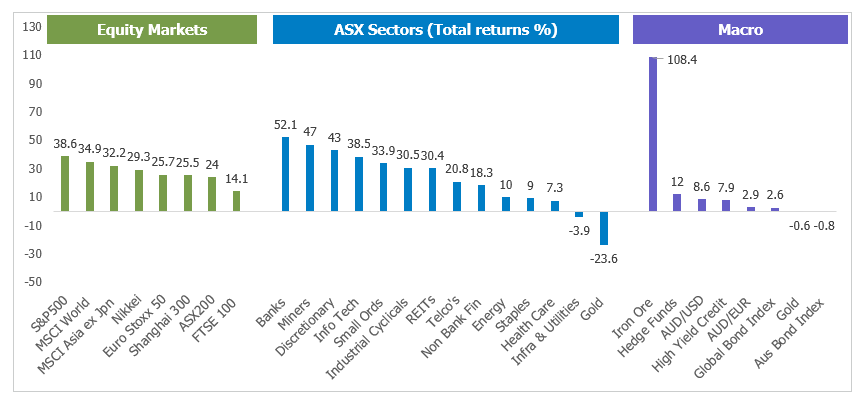

FY21 Performance – 12 months to 30 June 2021

Source: Bloomberg

A few key macro themes to reflect on for FY21

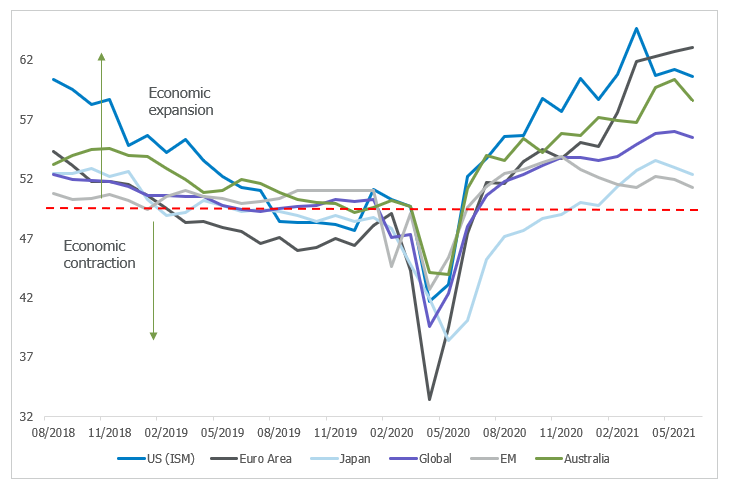

1) An uneven global recovery

The global economic recovery has been unsynchronised with variations in COVID vaccination progress and economic stimulus across countries, resulting in most regions travelling at varying speeds. The US has so far seen the fastest recovery in 2021, with the US ISM hitting the highest level in 40 years and the job market recovery also accelerating now. In Europe, PMI’s continue to make new highs, and whilst China’s economy has already normalised, the rest of the emerging markets are still well behind in the recovery.

Over the last few months, we have however started to see some of the activity momentum potentially peaking, such as US ISM, payrolls and retail sales as well as China’s credit impulse (the rate of change in credit growth) and M2 money supply. Post-pandemic labour and goods sector shortages are weighing on output, and the spread of the Delta variant is offsetting vaccination-related progress on new infections.

Global Manufacturing PMI’s

Source: Bloomberg

The Australian economy has weathered the COVID storm better in comparison to other major developed countries, with Australia’s GDP growth only contracting -2.4% in 2020 vs US -3.5% and Europe -6.7%. Consensus is currently forecasting Australia’s GDP growth to rebound to 4.8% in 2021 (according to Bloomberg). The economic outperformance has been underpinned by better health outcomes, material fiscal and monetary support, elevated confidence, and rising house prices, but the current COVID outbreaks and lockdowns will hit growth in the near term. We are already seeing downgrades to 3Q/4Q GDP estimates with the recovery pushed out further to 2023. More on this below.

2) Diverging Policies – Central banks going their own ways

In response to the uneven recovery, we’ve seen diverging paths for global monetary policy and fiscal support from the respective central banks. In the US, the Fed is still being patient with persistent support despite an increase in inflation, the ECB continues to reiterate their dovish stance. On the other hand, China has already started to normalise with slower credit growth and some smaller central banks have already become more hawkish. In Australia, the RBA has reiterated their dovish stance and fiscal policy remains active (especially since Delta related lockdowns).

Simply put, bond yields reflect investors’ expectations for future growth and/or inflation. When bond yields fall, it means that the market doesn’t expect as much future growth and/or inflation.

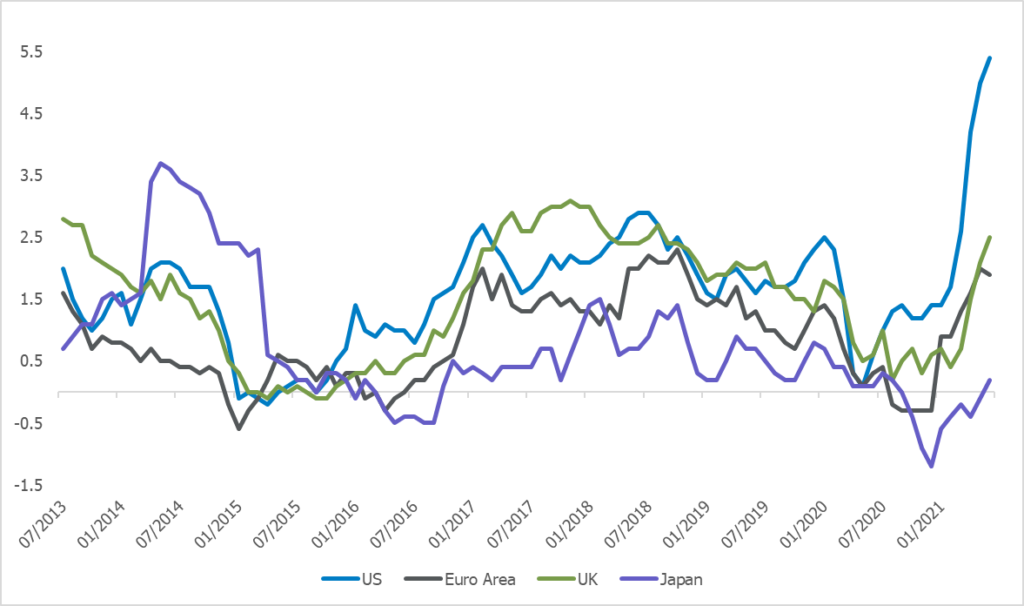

3) Inflation fears & whipsawing bond yields

Global inflation has accelerated as can be expected during a post-recession economic recovery. There is however little clarity whether this trend is transitory or whether a series of near-term factors, such as supply-side bottlenecks, semiconductor shortages and commodity price volatility, could prolong this trend. The Fed did try to calm runaway inflation fears when they signalled that rate hikes could start sooner (in 2023) than previously guided and that US inflation is expected to reduce from an average of 3.2% in 2021 to 2.1% in 2022.

Global Inflation (CPI, yoy)

Source: Bloomberg

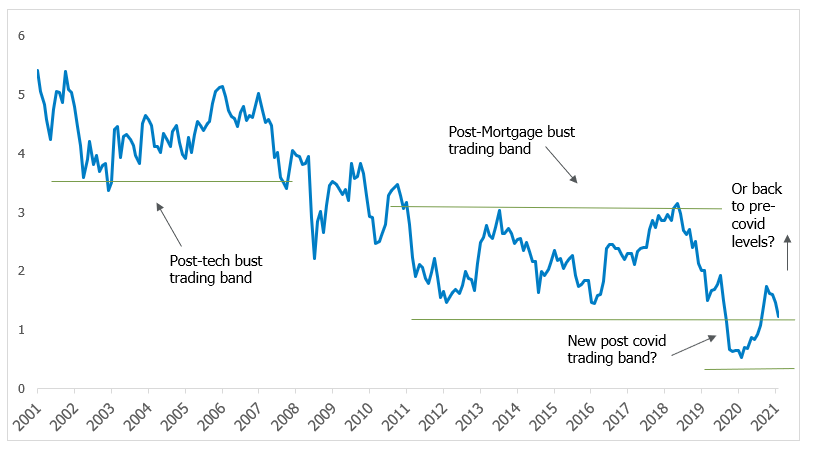

Bond yields – These inflation fears have not only caused uncertainty in equity markets, but also with bond yields that whipsawed over the course of the 12 months. During this period, we’ve seen a rally in inflation expectations and real bond yields, but a recent retracement in long bond yields during 2Q21 perplexed most market commentators, ourselves included. The US Fed’s “talking about talking about” tapering has been seen as evidence that inflation will be reined in and economic growth slowed in the process. Other possible explanations for the decline in bond yields include low bond inventory levels, technical factors (such as position unwinds), Delta variant, continued growth in Fed balance sheet or perhaps just the market getting worried about the sustainability of the pace of recovery, especially relative to expectations. As we head into FY22, equity market consensus expectations are certainly still for higher yields ahead when the taper comes, although the bond market is saying something different.

US 10-year Nominal Yield

Source: Bloomberg

4) COVID strains and vaccination efforts

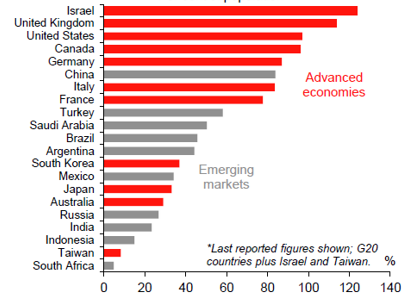

The US and the UK have been the leading major economies in vaccinations. Europe and China have also accelerated the pace of inoculating their populations, however, Asia and other emerging markets are lagging due to vaccine hesitancy and insufficient supply. The rollout programs in the US, UK and Israel are nearing maturity, with most of the “willing” population already vaccinated.

Australia has been lagging in the vaccination race, but the pace is now accelerating with research done by Goldman Sachs suggesting 50% of the population will be vaccinated by September 2021. By the end of the year all adults that want to be vaccinated in Australia should be able to get a jab as Pfizer supplies increase sharply.

COVID-19 Vaccination Doses Administered* (% of Population)

Source: Macquarie data, 30 June 2021

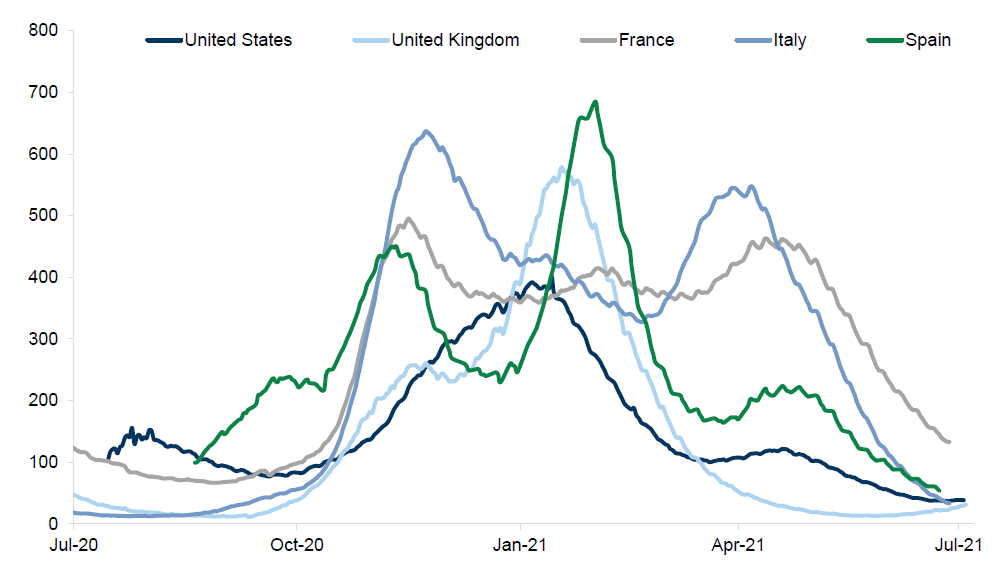

The sharp rebound in infections in the UK and the spread of the Delta variant across much of the world, has resulted in renewed restrictions in many countries. The good news is that the vaccination results have been spectacular so far, with both the medical evidence and the aggregate UK data showing that the vaccines remain highly effective against the variant, especially as far as hospitalisations and deaths are concerned.

Hospitalisations have decreased despite increasing cases in the UK

Source: GS data, 8 July 2021

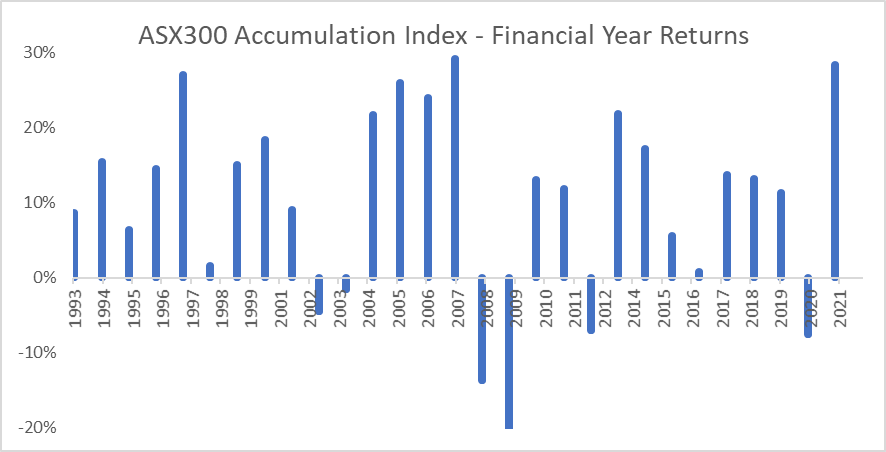

Equity Market Returns – FY21 – One of the best on record

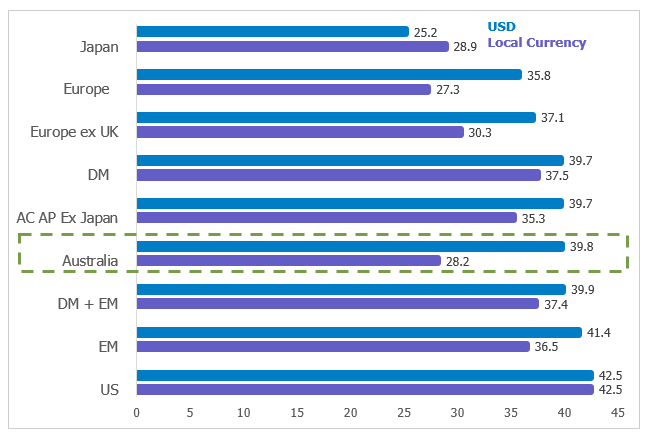

Global equities – Equity markets tend to do very well in the year following a recession, and this financial year proved no exception. Led by US markets, notably large US tech names, global stocks rallied to fresh record highs in the June quarter. Global equities (MSCI World ex Australia index in local dollars) closed the financial year up an impressive +37% and compared to their worst COVID-19 pandemic panic low levels in March 2020, global stocks are up roughly 90%.

Equity Market Returns – 12 Months to 30 June 2021

Source: Bloomberg

Australian equities – The ASX200 enjoyed the strongest financial year for the market in over 30-years, returning 28% in AUD over the 12 months, vs the average annual return over that period of 10.4%, driven by a cyclical rally in commodities and banks. Even though the Australian economy outperformed on a global basis as mentioned above, the Aussie stock market lagged other major global indices in local currency terms, but were one of the top in USD terms up c40%, with the AUD weakening vs the USD.

Source: Bloomberg

Sector heavyweights of Banks (+52%) and Miners (+47%) led the outperformance during FY21, amid a strong economic recovery, booming commodity prices, vaccine optimism, and reflation expectations. Discretionary Retail (+43%) performed strongly given the combination of unprecedented fiscal support to households and COVID restrictions that greatly reduced spending options.

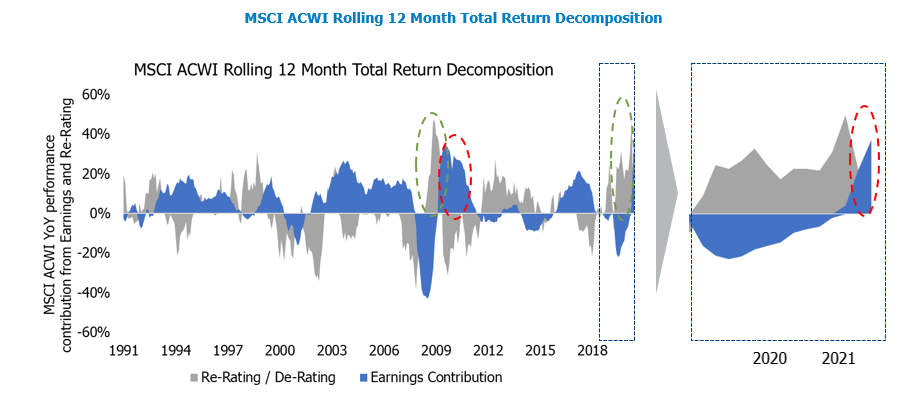

Earnings growth the major driver of returns in FY21

Earnings have been the overwhelming driver of stock market returns over the 12 months to June across all regions (except China) as valuations (PE’s) have contracted. This follows FY20, which saw massive equity market expansion without earnings growth. A typical equity market cycle, but at a much faster than normal pace.

In the US for example, earnings have grown by +25% on a 12-month trailing basis, with the first quarter of 2021, delivering some of the most exceptional results from S&P 500 companies in modern history (earnings beat expectations by over 20% and grew 50% year-over-year. Meanwhile, the S&P 500’s forward multiple has fallen more than a full turn since the start of the year (from 22.4x to 21.3x). Initial results from the current 2Q21 reporting season underway suggest another stellar quarter.

Elsewhere, Developed Markets ex-U.S. and Emerging Markets have seen earnings growth of 29% and 22% during FY21, respectively, and their forward multiples have also fallen. In Australia, the forward earnings expectations are higher by 34% at the index level over FY21, while PE’s have compressed c.10%.

MSCI ACWI Rolling 12 Month Total Return Decomposition

Source: Alphinity, BoA data

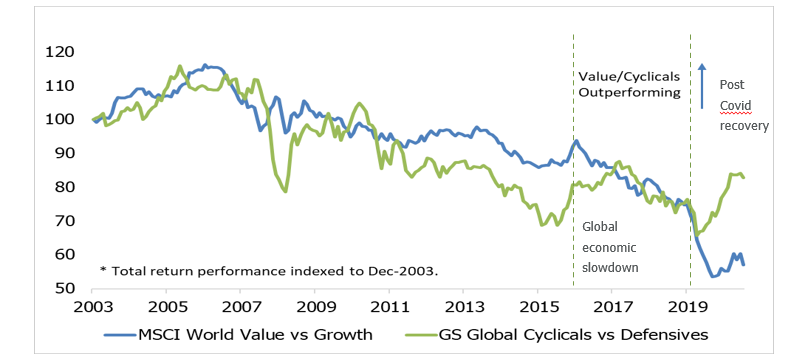

Multiple style leadership changes over the 12 months

Over the 12 months, equity markets have also experienced multiple style leadership changes. From the March 2020 low to the beginning of this year, we saw a shift towards more cyclical and value leadership reflecting a strong inflection point in growth and inflation expectations following unprecedented policy support and progress on vaccinations. However, despite the strongest economic recoveries in history and a starting point of unprecedented valuation dispersion, the cycle has so far seen the weakest Value rotation in 30-years.

During the quarter to June, we saw a rotation back into growth and defensive parts of the market, coinciding with a peak in growth momentum and a shift in inflation expectations following the shift in the Fed’s dot plots (revising their interest rate outlook).

Global Cyclicals/Defensives YoY Total Return vs Global Value/Growth

Source: Bloomberg, GS data, 30 June 2021

FY22 and beyond – Leaving explosive growth behind

1) Macro tailwinds and headwinds ahead

The ongoing global economic recovery, supportive monetary and fiscal policy and impressive corporate earnings creates a backdrop that could well continue to be positive for risk assets, such as equities, should none of those drivers disappear too soon. Manufacturing growth rates are peaking, but Services, a much larger share of the economy, should continue to recover. The global supply chain is still very empty, but we are seeing first signs of some normalisation.

Potential risks include an unexpected inflation spike, onerous tax rates damaging profits or central banks pivot from the current supportive stance. The progress of COVID vaccinations and the extent of new variants and infection rates will also play a major role in the next phase of the recovery.

Compared to 6-9 months ago, the global economic recovery is now well understood by investors. The initial explosive demand growth meant economists scrambled to catch up with reality, upgrading their GDP growth forecasts aggressively, but more recently, as growth has begun to decelerate, there have been some slight disappointments.

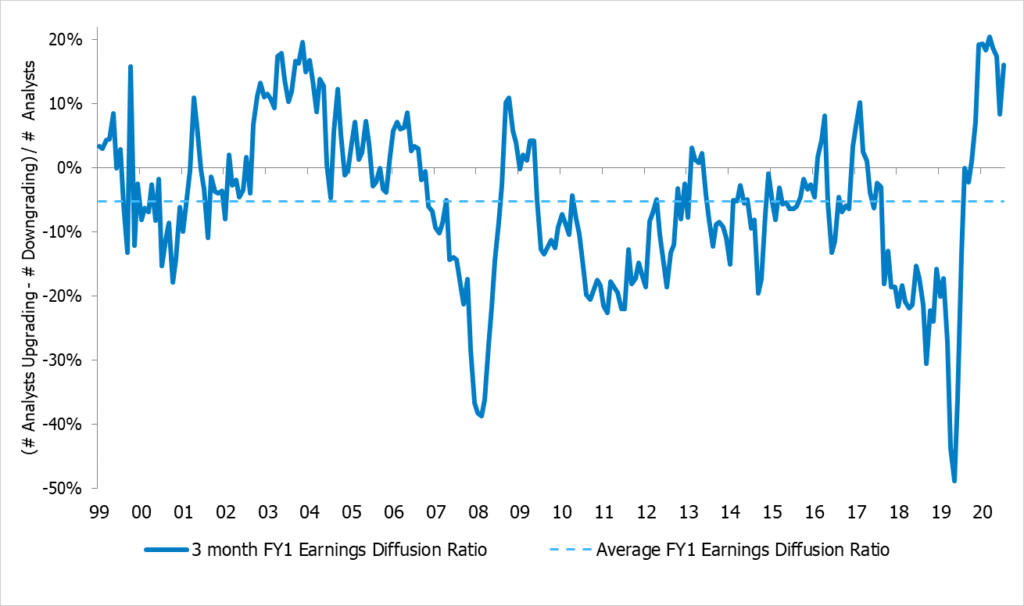

2) Earnings cycle is maturing, and valuations already reflecting a lot of the good news

Global earnings have continued to be revised higher over the last 12 months, recovering to post recession highs at the fastest pace on record, boosted by very strong reporting seasons in the US and Europe. Earnings sentiment (as measured here by the Alphinity Diffusion Index) has remained elevated during FY21, reaching 30-year highs, but has recently moderated. Consensus is now expecting MSCI World earnings growth of 40% for 2021 and 11% for 2022. In terms of sectors, the EPS revisions have been concentrated into Value/Cyclical sectors: Financials and commodity-exposed sectors have experienced the strongest revisions on the back of the improving macro outlook and increasing commodity prices. There are however some signs of earnings momentum fatigue, with some downgrades seen in some cyclical sectors for FY21 and FY22 estimates during June 2021.

Australian earnings upgrades have continued for both FY21 and FY22 driven by domestic (and global) monetary and fiscal stimulus together with reopening of economy, despite temporary setbacks. Rather than broadening out, the heavy lifting has continued to be done by Resources, and more recently Energy and continued tailwinds for COVID beneficiaries. Defensive sectors, such as consumer staples, comm services and utilities have seen persistent downgrades over 2Q21.

Australia FY1 Earnings Sentiment Indicator

Source: Alphinity, 30 June 2021

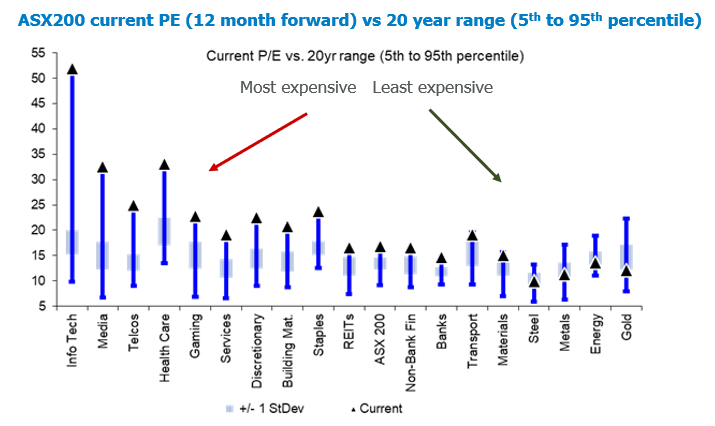

Equity valuations already pricing in a lot

Equity markets have already rallied strongly, and while corporate earnings have also surged back in-line with growth, this has been needed to justify elevated valuations. Most developed equity markets are trading at the upper end of their 20-year trading band and the dispersion between value and growth valuations remains elevated. The ASX200 is currently trading on a PE f of 18.3x, which is c20% above the 20-year average. Across sectors, IT and media valuations are looking extreme, with the best value still in some cyclical sectors, although being supported by extreme commodity prices in many cases.

ASX200 current PE (12 month forward) vs 20 year range (5th to 95th percentile)

Source: GS data

3) Bond Yields & Equities

Inflation expectations, bond yields and the slope of the yield curve can have a significant impact on equity markets and relative sector returns. Higher yields increase the discount rate at which a company’s future earnings are discounted at, hence reducing the valuation of the stock. A rising rate environment therefore increases the risk of higher rated assets (or longer duration assets), such as IT stocks, relatively more than cheaper/lower rated stocks. In a rising yield environment, cyclical sectors, such as financials, industrials and materials, have historically outperformed the index as their earnings have a higher correlation to the growth of the economy. That is not to say that markets can’t continue to outperform if inflation increases or bond yields rise, but more that the heavy lifting needs to be done by earnings growth than multiple expansion.

Alphinity’s current positioning – A balanced approach for a winding road ahead

At Alphinity we construct our portfolios based on company specific earnings leadership opportunities and do not make specific sector/country bets. The portfolios will adjust to changes in earnings leadership within the market as they arise.

The varying pace of the global recovery warrants a more active approach in our view when allocating by region, asset class and underlying sectors within equity markets. At Alphinity, we remain optimistic on the global growth outlook, but we also believe that the most explosive part of the recovery is now behind us. The strong market rally has clearly raised risks, and periods of elevated market volatility seem likely from here.

In Australia, underlying earnings momentum remains positive, but we are past the peak and are not yet seeing a broadening out of earnings revisions. During the first part of FY21, we continuously tilted our portfolio to more cyclical exposure, such as financials and commodities. Over the last quarter, the combination of the maturing cyclical growth, a more unpredictable bond market and, importantly, company specific earnings drivers have seen us continue to reduce single commodity Resources stock exposure (partly offset by increased Energy) with new investments in higher long term growth opportunities where we see earnings upside relative to market expectations (examples include Resmed, Aristocrat and Domino’s). As we enter FY21, we are overweight Energy, Other Materials, Consumer Discretionary, Healthcare and Financials. We suspect the last word might not yet have been said about inflation, as there are now more companies talking about having pricing power than at any time in the last decade or so and as a result we remain underweight bond proxies.

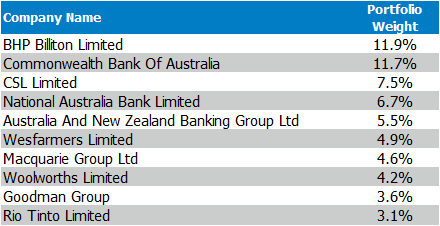

Alphinity Concentrated Australian Share Fund – Top 10 positions

Source: Alphinity, 30 June 2021

Our global equity portfolios continue to be positioned around the two dominant drivers of global earnings currently: the cyclical recovery, but also various structural, longer term growth stories. We have maintained investments in our favourite growth stocks through the recent recovery cycle, as the earnings outlook for these businesses remain under appreciated by the market. We believe both the cyclical and growth parts of the equity market continue to offer attractive investment ideas. In contrast, we remain less invested in defensives, which are still facing various earnings headwinds, although we are doing increasing amounts of work in this area to prepare for any potential change in earnings leadership. These views are reflected in the active sector weights, where we are overweight in financials and consumer discretionary, with the biggest underweight position in consumer staples. We are on high alert for signs that analysts have over extrapolated current cyclical trends, with overly bullish analyst expectations one of the classic end-of-cycle signals.

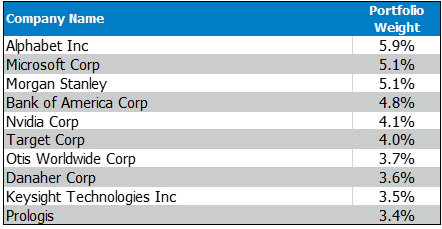

Alphinity Global Equity Fund – Active ETF – Top 10 positions

Source: Alphinity, 30 June 2021

Author: Elfreda Jonker, Client Portfolio Manager