“The risk of underinvesting is dramatically greater than the risk of overinvesting” (Sundar Pichai, Alphabet CEO, 23rd July 2024).

This quote from the Alphabet CEO during the Alphabet 2Q earnings call amplified investor concerns around the current Artificial Intelligence (“AI”) investment landscape. The technology industry appears to be engaged in a high-stakes race to develop AI infrastructure, while the potential returns on these massive investments remain ambiguous.

Given the substantial market share and valuation premiums now commanded by AI-focused companies, there’s mounting pressure for these firms to demonstrate tangible returns on their AI investments. Investors are increasingly looking for concrete evidence that the massive capital inflows into AI infrastructure and development will translate into sustainable revenue streams and long-term profitability.

Despite market impatience, we are observing encouraging signs of AI’s impact starting to emerge from both the revenue and expense sides of businesses. Substantial returns will however take time to materialise. Given the current market dynamics, we remain nimble with our AI exposure in the short term, but unequivocally convinced on the longevity and scale of the AI opportunity over the long term.

Where are the returns?

Market concerns around overinvesting in AI are not without precedent given the technology sector’s history of several technology boom-and-bust cycles: From the 1990’s internet era exuberance leading to the dot.com crash, to the recent hype around the metaverse (virtual worlds), Web 3 (decentralised internet vision), and even non-fungible tokens (NFT’s). These examples serve as cautionary tales, illustrating how technology hype can outpace real-world applications, leaving a trail of poor returns and crushed share prices in their wake.

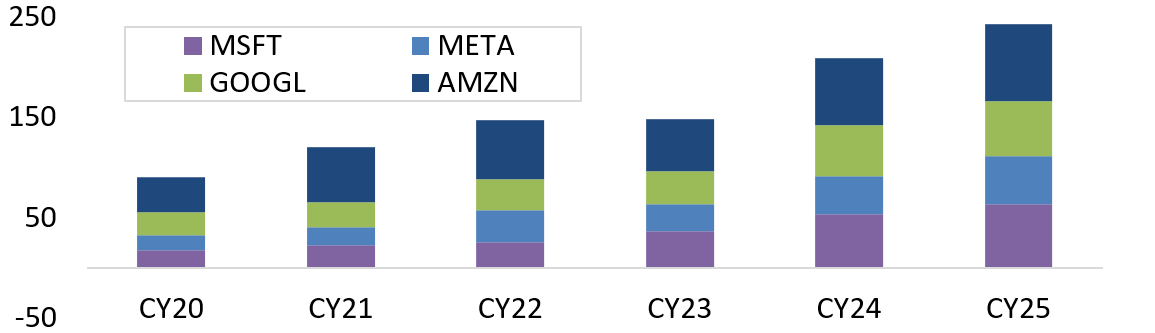

Current investment levels into AI architecture are extraordinary. Hyperscaler (Microsoft (NASDAQ: MSFT), META (NASDAQ: META), Alphabet (NASDAQ: GOOGL) & Amazon (NASDAQ: AMZN)) capex will rise more than 40% in CY24 and is expected to rise further in CY25 to levels 2.5x what they were in CY20. This level of investment is starting to have an impact on financial returns for these companies, both in terms of cash flow returns and on margins as higher depreciation flowing from this investment begins to bite in the P&L.

Hyperscaler Capex ($bn)

Returns take time to materialise

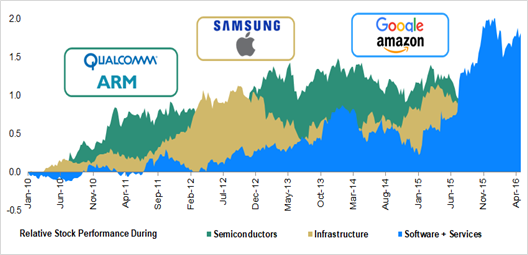

In any major technological transition – be it internet, cloud computing, or the current wave of generative AI, there is a consistent pattern: infrastructure development precedes widespread application and the realisation of value. The internet evolution provides a compelling case study, where the true value from end applications and the resultant share price movements only started to emerge after 3 years and really gathered momentum after 5 years.

Internet Cycle Stock Performance

We can see a similar phenomenon play out with generative AI. Cloud AI services are beginning to inflect, as evidenced by recent results showing a reacceleration in cloud demand but several cutting-edge AI applications such as Edge AI, Smart Robots and Multi-Agent Systems are still in development and yet to reach widespread commercial deployment.

Where are the end applications?

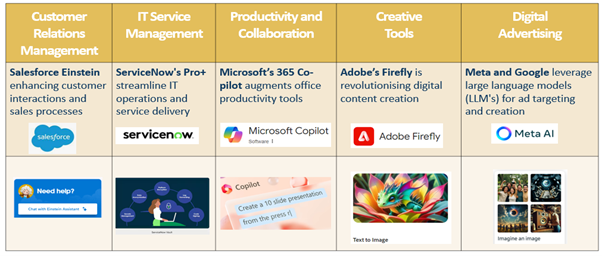

Contrary to the notion that end applications of AI are not yet visible, we’re witnessing a robust proliferation of AI-powered solutions across various sectors already emerging just ~20 months after the emergence of GEN AI.

While these applications are in their initial phases and will take time to scale, their market potential is substantial. Take for example the M365 co-pilot example: a US$30 subscription fee per month across their 160m high value commercial users, could add $58bn revenue annually (a +23% lift to FY24 revenue). Expansion to the remaining 200m commercial users and integration into broader product offerings offer additional upside.

Returns from “efficiencies”

The impact of generative AI on business efficiency and productivity is emerging as a transformative force, with potential returns far exceeding initial revenue gains. This trend, while significant, remains underappreciated due to public concerns about AI-driven job displacement. However, real-world applications are already demonstrating substantial benefits across diverse industries. Companies are implementing AI with measurable success. For example:

- Uber (NASDAQ: UBER) is using gen AI to enhance customer service and marketing efforts;

- Mercado Libre (NASDAQ: MELI) is optimising capacity planning and fulfillment operations;

- Wipro (NASDAQ: WIT) is using it to boost software development through code assistance & documentation;

- Best Buy (NASDAQ: BBY) is deploying AI-powered trouble-shooting assistants.

Importantly, companies are beginning to qualify these benefits well beyond the bounds of tech:

- Walmart’s (NASDAQ: WMT) quantified generative AI’s contribution to catalogue creation in their recent results call with the CEO stating that: “without the use of generative AI, the work would have required nearly 100 times the current head count to achieve what we did using generative AI”

- Pfizer (NASDAQ: PFE) is leveraging AI as a key component in a $4bn operating expense reduction initiative;

- American Express (NASDAQ: AXP) is realising a 30% higher response rate on corporate offers through AI assistance; and

- L’Oreal reported a 10-15% boost in advertising productivity, by spotting trends (using “Trendspotter”) early and marketing to online shoppers.

The list goes on. The adoption of generative AI is rapidly expanding, with companies across various sectors reporting emerging and expanding use cases.

How to quantify these returns

Quantifying the actual returns from generative AI can be a difficult exercise. For example, disaggregating how much of the Meta revenue acceleration comes from product enhancement due to Gen AI is complex, as is product augmentations flowing from its application to existing capabilities.

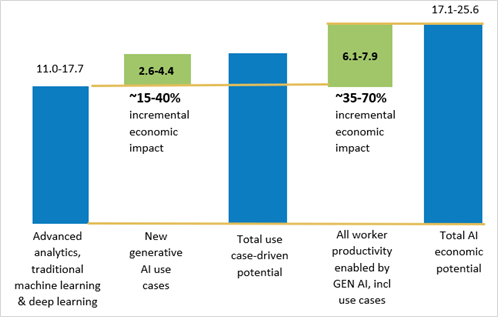

Stepping back to a broader economic perspective, McKinsey undertook a study trying to piece together the incremental value that generative AI could bring. The total value was $6.1tr – $7.9tr annually across specific generative AI use cases and general productivity.

Taking specific use cases, McKinsey’s comprehensive analysis of generative AI applications provides a detailed roadmap of its potential impact across various business functions. McKinsey identified activities within business functions where generative AI could be applied and then calculated both the efficiency impact (as a % of functional spend) and the aggregate size of the opportunity. Remarkably, 75% of the generative AI impact was across a handful of functions spanning sales, marketing, product R&D, customer operations and software engineering, estimated to be a c$400-500bn impact across each function.

Interestingly, we are beginning to get validation of some of these data points in our conversations with company management teams, for example in software engineering the efficiency/cost boost figure of c. 30% is now being discussed. Looking ahead, we will continue to monitor validation points of this return profile, but if this current trajectory of efficiency gains persists across various business functions, it suggests that the substantial investments in AI infrastructure are likely to be more than justified.

What this means for our portfolio

While we have belief in the longer-term return profile to flow from generative AI, we are also mindful of valuation and expectations across those stocks most exposed to it, and the correlations within the portfolio to the general AI theme. As such we have recently harvested some of the AI gain, while maintaining a positive portfolio exposure. Most noticeably, we have trimmed back Nvidia, Microsoft and Alphabet while SK Hynix (Korean memory company) has been divested. It is a recognition that rallying share prices are factoring in some more of the future gains, and that the outcomes for returns on investment – while firming up – continues to have relatively large variability.

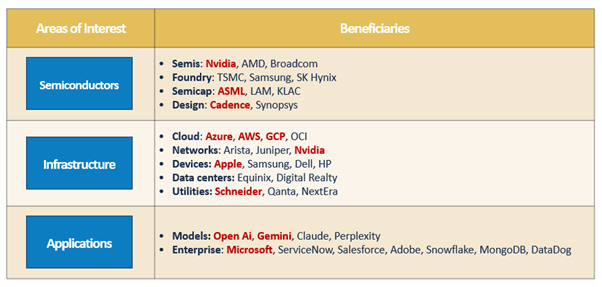

Existing AI exposure (in red) – Navigating a changing environment

We remain convicted on the transformational power of AI but will manage our positioning according to valuations and be vigilant in validating data points that the AI return profile is continuing to emerge. This includes numerous global investor trips, where one of the key questions to all companies will be: “Tell me how you are using AI and what benefits are you seeing?”