With International Women’s Day earlier this week it feels like a good time to take the opportunity to highlight our thinking around gender diversity.

Last year we made a commitment to the 40:40 Vision initiative, a collaborative investor-led initiative which aims to achieve gender balance at Executive Leadership level (CEO-1) within ASX200 companies.

Gender diversity is one of the only ESG metrics that links directly to company performance. We know that having a diverse workforce leads to new ideas, a stronger work culture, better employee sentiment and retention, better leadership, and ultimately better business outcomes and higher returns. We engage with our investee companies around all types of diversity, including gender, and seek to understand their existing situations, the challenges they face in improving gender splits across their business, and forward-looking plans to address issues.

Joining the 40:40 Vision has driven us to look more closely at the gender balance across the companies in our portfolios. As a result, we have committed to a number of specific engagements through our role in the 40:40 Vision working group and completed analysis that will help us focus on the companies within our portfolio that need some extra encouragement.

Background

This year, the International Women’s Day theme is #ChoosetoChallenge. It’s easy to forget how long the women’s movement has been fighting for equality, and it’s easy to become complacent when an issue has been discussed for such a long time. The first year an International Women’s Day was held in Australia was all the way back in 1928. That event was organised by the Militant Women’s movement and called for equal pay for equal work. Since then, International Women’s Day has continued to grow. It is a day to celebrate women’s achievements and both highlight and work to address barriers that continue to perpetuate gender inequality[1].

Although we have come a long way since the early days of the women’s movement, there are still some surprising statistics[2] that tells us there is a lot more work still to be done. For example:

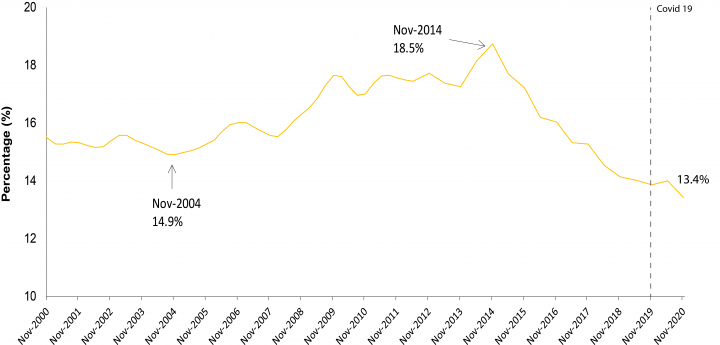

- In the past 10 years we’ve seen the national gender pay gap fluctuate between 13% and 18.5%. In November 2019, 91 years since the first March, women still earned on average 13% less per week then men

The Australian national gender pay gap, November 1999-November 2019[3]

- Among non-public sector organisations with 100 or more employees, the gender pay gap for full-time annualised base salary is 15%, and 20% for full-time annualised total remuneration

- The median undergraduate starting salaries for women are 2.5% less than for men. This gap widens 13% for postgraduate (coursework) graduates

- Median superannuation balances for women at retirement (aged 60-64) are 22% lower than those for men

Interestingly New Zealand boasts the lowest gender wage gap in the OECD at 6%. At the other end of the scale, South Korea reports a significant 37% gap in their wage median. We can see Australia sits on the better end of the spectrum[4], however with leaders such as Belgium, Greece, Norway and Spain holding superior gaps of less than 9%, it’s clear there is some work to be done in this space.

#ChoosetoChallenge

Thinking about our role as investors and ways in which we can support the achievement of gender equality, we #ChoosetoChallenge poor performance and lack of action by companies around gender equality. More specifically, we #ChoosetoChallenge false or misleading statements which inhibit gender equality within Australian listed companies.

Too often, when we ask about a lack of gender equality within a business, senior management are quick to rattle off any number of justifications for why their gender diversity metrics are unimpressive and lag behind peers. Since we started engaging with various companies on this issue, we’ve heard a range of different reasons — the following stand out the most:

- “There aren’t enough women for the role”

- “Targets drive the wrong outcomes. We want the best person for the role”

- “No-one wants to be the token female – hired just because she’s a woman”

- “Women just don’t want to work in <insert male dominated sector here>”

- “We don’t get enough women applying for jobs. We can’t help that”

- “There are plenty of programs to support young women to enter the workforce. If we just give it time, this will lead to stronger female senior leadership representation”

To overcome these barriers, companies need to implement better programs to actively source female candidates for roles. These include fostering female leaders, blind hiring processes to address unconscious bias, having gender balanced interview panels, rethinking parental leave and flexible work policies to encourage men and women to have families without sacrificing their careers, supporting young women to enter the workforce and striving to improve diversity across all areas of business, thereby creating an environment that’s inclusive.

Gender diversity in the ASX200

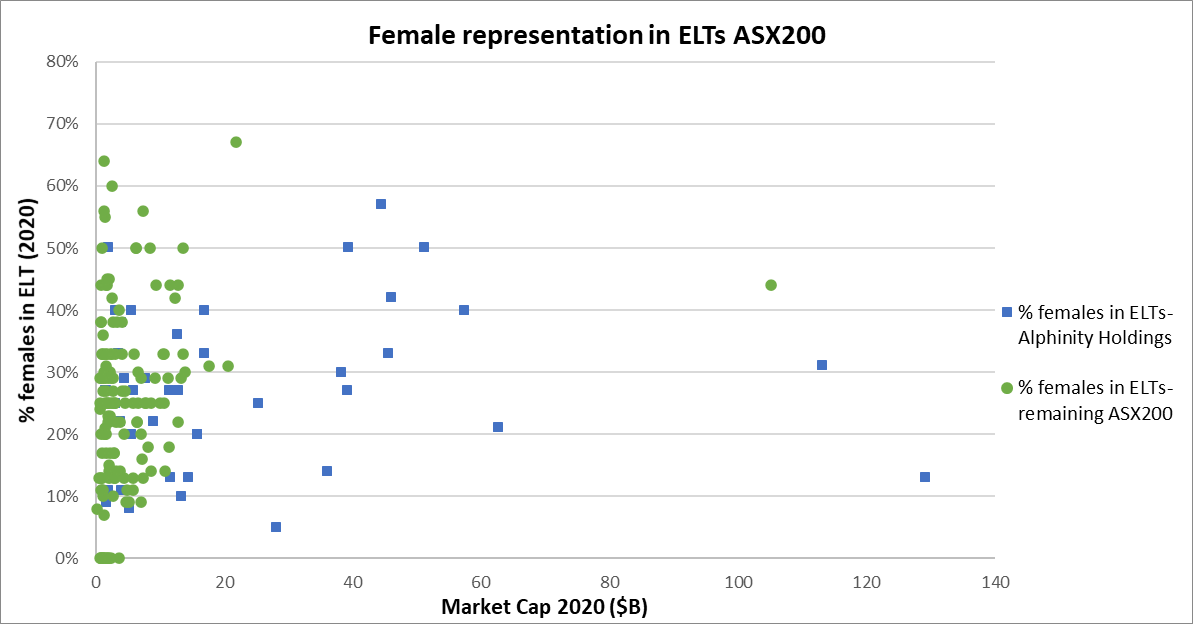

The below graph plots 2020 gender diversity data against 2020 market cap data for the ASX200[5]. Overall, there is a definite relationship between the size of the business and the percentage of women on their Executive Leadership Teams (ELTs), however the correlation is weak and there are a large number of outliers.

Clearly at the lower end of the market cap range (<$20B) it’s most common for companies to have less than a 30% female to male ratio. There are also a small cluster (bottom left) that are showing 0% representation. In some cases, this is due to non-disclosure rather than actual performance.

For companies at the very small end (<$2B), the average representation of women on ELTs is 23%. Although this indicates that smaller companies find gender diversity more challenging, and the smaller a company is the more likely they will have a more male dominated executive team, it doesn’t support that claim definitively. Equally, when looking at the larger end of the market cap range, we are unable to draw a conclusion that larger companies manage gender diversity more easily.

This reinforces the need to discuss gender diversity through a range of engagements, regardless of the company size.

How we’re engaging with companies

We engage with our investee companies around all types of diversity, including gender, and seek to understand their existing situations, the challenges they face in improving gender splits across their business, and forward-looking plans to address issues.

Through our engagements we hear many positive stories about how companies are seeking to improve gender diversity right across their business, and we believe the vast majority of the companies we are speaking to have the right intention. Companies like Bluescope Steel, ANZ Bank, Transurban, BHP, and Wesfarmers have all achieved at least 40% representation of females within their ELTs and, from our understanding of their approach, it’s clear that they take gender equality very seriously and have a robust and embedded approach to achieving gender balance across all parts of their business.

The 2020 CEW Senior Executive census[6] highlights that since 2017, the number of organisations that have achieved gender balance in their ELTs has almost doubled, from 16 to 30 companies. They also highlight that across all ASX200 companies, 25% of ELT roles are now held by women.

When engaging with companies on this issue, especially where their gender splits are less than 40% female (across any area of the business), we generally encourage them to:

- Make a commitment to the 40:40 Vision initiative and set goals with action plans towards achieving gender equality

- Disclose clear metrics and performance related to gender diversity at the Board, Executive Leadership level, and across their whole workforce

- Engage with peers and learn from others in the market

- Communicate challenges and outline strategies to overcome them

To achieve gender equality, we need to continuously challenge misconceptions, false assumptions, and call out gender biases and inequality. We recognise the challenges in achieving gender balance in traditionally male dominated sectors, however given the growing number of companies that have managed to overcome the barriers, our expectations on what’s possible are changing.

We’re excited to be part of the 40:40 Vision investor working group and we hope that a collaborative effort to engage with Australia’s largest companies will help change the gender diversity landscape for the better.

Author: Jessica Cairns, ESG & Sustainability Manager