Everybody knows Microsoft. It is a business that has been the bedrock for how we get things done for decades. From taking notes, creating valuation models, producing presentations or attempting to write interesting stock reviews (welcome to my life), the Microsoft suite of products and services have been the foundation of our work and study lives for as long as we can remember. But this constancy and longevity of the basic product set masks what has actually been a remarkable transformation of the Microsoft business in recent years. These business changes place Microsoft at the apex of the three key characteristics that all leading software businesses strive for: depth of engagement, leadership in cloud and a recurring revenue model. In this note we explore each of these characteristics in more detail and conclude on their combined contribution to the compelling investment case for shareholders.

Deepening engagement: Teams as the poster child

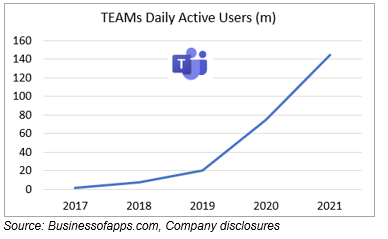

The deepening of engagement with the Microsoft platform has been extensive in recent years, with tools such as Teams, OneDrive, OneNote, Power Apps and Yammer added to the core Office 365 offering. The communication platform ‘Teams’ has been an incredible story as when it first entered the market in 2017, Slack was by far the dominant enterprise communication platform. But the launch of Teams under the Microsoft umbrella brought with it a communications platform naturally ingrained with the Microsoft product suite enabling deeper and more natural integration with workflows. This integration with the Microsoft product suite combined with a compelling price point (basically free) saw Teams become the enterprise communication platform of choice within three years. The onset of COVID19 and remote working saw the Teams platform become further embedded as a critical tool for enterprise communication globally.

Cloud: an industry leader with Azure

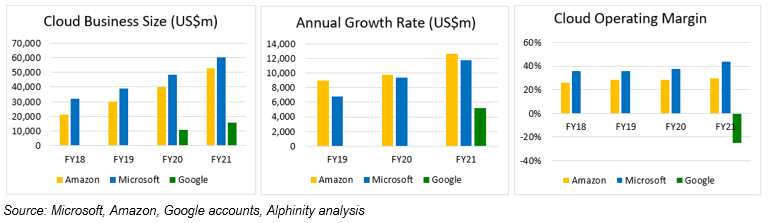

While the deepening of customer engagement has been impressive, the key jewel in the Microsoft crown is the cloud computing business Microsoft Azure. The cloud computing space currently has three scale players battling it out for market share: Amazon’s AWS, Microsoft’s Azure and Google’s GCP. Given the accelerating migration of workloads to the cloud, these businesses have been experiencing growth rates of 30-50% in recent years, with strong growth expected to continue over the medium term.

While Amazon’s AWS was winning the race for scale in 2019, Microsoft has been closing the gap in recent times with incremental $ additions on par with AWS. The other impressive aspect of the Microsoft cloud business growth has been the maintenance of strong margins of 40-45%. Not only is cloud a compelling space in terms of growth, but the return profile is also exceptional for players such as Microsoft that can establish a leading scale position.

Recurring revenue model: the holy grail of software

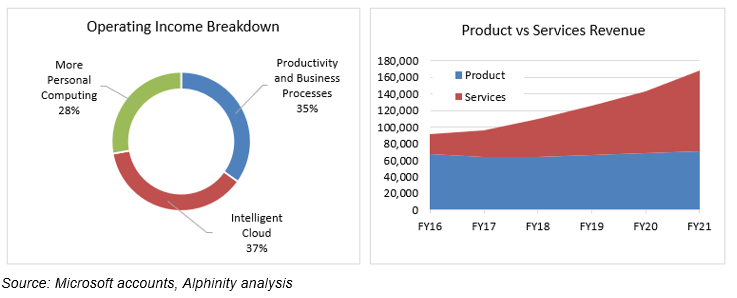

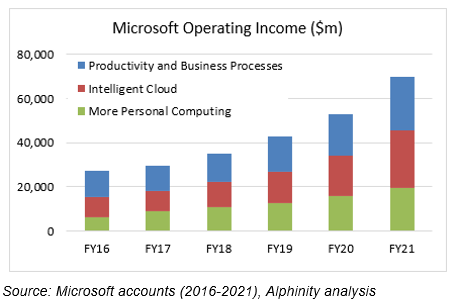

Overlaying the engagement expansion and strong cloud position has been the fundamental reshaping of the nature of revenue that Microsoft derives. Microsoft is successfully moving the business from a license-based model to a recurring revenue model, with this transformation permeating across all elements of the business. While the ’Intelligent Cloud’ division is an important component of this shift, the conversion of the Office product suite into the subscription-based Office 365 also changed the nature of the ’Productivity and Business Processes’ division to one not dependent on step-change functionality upgrades to drive subscriptions. The ’More Personal Computing’ division is also transforming as Microsoft moves towards streaming the core Windows operating system as well as establishing ’Xbox Game Pass’ as a subscription based multi-platform gaming subscription service. This revenue shift to recurring subscriptions materially enhances the quality of Microsoft’s earnings given the reduction in volatility.

What does this transformation mean for value?

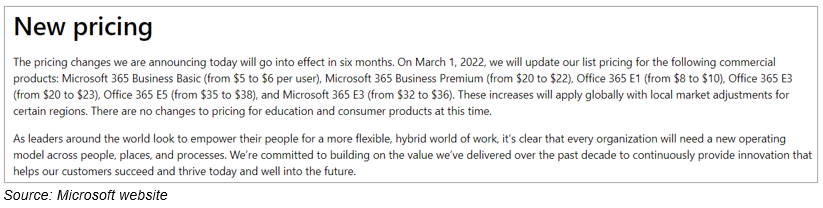

Rolling these three elements together creates an important shift not only in the growth outlook for Microsoft, but in the quality and therefore value ascribed to Microsoft’s earnings. The expansion of engagement depth not only ensures that Microsoft’s customer base doesn’t fragment across different enterprise company offerings (like Slack), but the greater value provided to customers also allows Microsoft to increase pricing. This has been borne out last month when Microsoft announced pricing increases while pointing to the extensive expansion of services that the core platform now provides. The Cloud business positioning in a highly attractive and profitable industry segment adds an additional layer to this growth momentum. Enveloping this growth is the increasingly recurring nature of revenue and the greater stability that such revenue provides. This lower volatility and risk profile increase the multiple that should be ascribed to the Microsoft earnings base.

Conclusion

Microsoft has been compounding revenue at mid-teens and earnings at >20% over the past five year as the forces of product set innovation and workplace dispersion wash their way through what was already a powerful business. Growth of 15-20% in operating income is expected to continue over the medium term as cloud migrations, digital adoption and the general recognition of the value of the Microsoft product offering continue to underpin business momentum in the years to come.

Augmenting the growth outlook are compelling profitability metrics. Microsoft generates 25% Return on Invested Capital (ROIC), 40% Return on Equity (ROE), has net cash on the balance sheet of $70bn, and generates >$50bn Free Cashflow (FCF) p.a. placing it in the top echelon of cash generative businesses.

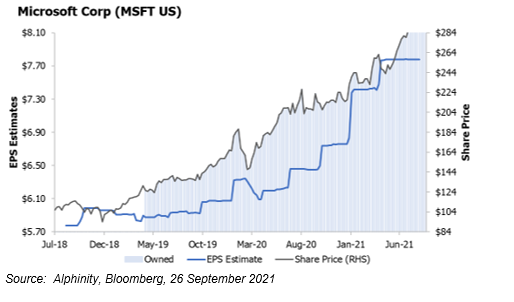

In terms of valuation, despite a lift in the share price, the valuation remains compelling. On a Price/Sales basis, MSFT trades on 10.7x against a software peer group on 20.9x despite offering a growth profile only a few points lighter than software peers. Turning to earnings and considering growth, in 2022 Microsoft is trading on a Price-to-Earnings-to-Growth (PEG) ratio of approximately 2.0x which is very attractive given the nature and positioning of the business at the apex of enterprise transformation.

The combination of business positioning, return metrics, earnings leadership and supportive valuation makes Microsoft a compelling long-term structural growth investment in both our Alphinity Global Equity and Alphinity Global Sustainable Equity Fund – Active ETFs.

MSFT – A long term Alphinity holding – Enjoying ongoing positive earnings momentum

Microsoft: ESG and Sustainability Considerations

Microsoft’s cloud-based software solutions have transformed the way businesses, education providers, and individuals communicate and approach work. These solutions improve access to education, support more productive economies, and reduce inequalities of outcome for people in remote or disadvantaged parts of our society (SDG8, SDG10, and SDG4).

Microsoft is well-known as a leader in ESG management. It has a strong focus on environmental and social sustainability and has been certified as carbon neutral since 2012 (with the use of offsets).

Microsoft has pledged to be carbon negative by 2030, but due to the power required at its data centres the company has a relatively high direct carbon footprint (SDG13). To manage this, it has committed to 100% renewable energy by 2025 and will invest $1 billion over the next four years to help increase the development of carbon reduction and removal technologies.

Author: Trent Masters, Global Portfolio Manager

Want more information?

Fidante Partners Adviser Services | p: 1800 195 853 | e: bdm@fidante.com.au | w: www.fidante.com.au

Fidante Partners Investor Services | p: 13 51 53 | e: info@fidante.com.au | w: www.fidante.com.au

Alphinity Investment Management | e: contact@alphinity.com.au