A stronger and less risky institutional securities franchise, coupled with further diversification into its leading wealth and investment management segments, have set Morgan Stanley up for a period of sustained growth.

Morgan Stanley: Earnings leadership at an attractive price

Source: Factset, Bloomberg and Alphinity

The last decade has been spent rebuilding and diversifying into more durable sources of revenue: After a difficult GFC, Morgan Stanley has cleaned up its’ balance sheet, rebuilt capital, accelerated technology investments and diversified into wealth and investment management. The Institutional Securities Group (ISG) contributed ~42% of pre-tax group profits (pro-forma) in 2019, down from 74% in 2010. This should make Group profitability significantly more resilient.

Strategy vindicated by exceptionally strong 2020 financial performance: The new strategy was successfully road-tested in 2020, where despite unprecedented stress Morgan Stanley delivered record revenues and a return on tangible capital employed (ROTCE) of 15.4%, while still maintaining significant excess capital. The Group performed well across all three divisions driving the Group pre-tax margin to 35% (vs 20% in 2014).

Entering 2021 with strong momentum and several astute acquisitions are likely to accelerate growth further: The acquisitions of E*Trade (2020) and Eaton Vance (likely close 2Q20) bring large cost synergies and significantly enhance the scale and competitive positioning of the Wealth and Investment Management units. Morgan Stanley now has three connected world-class businesses of scale, with pro-forma assets under management of ~$5.4 trillion dollars.

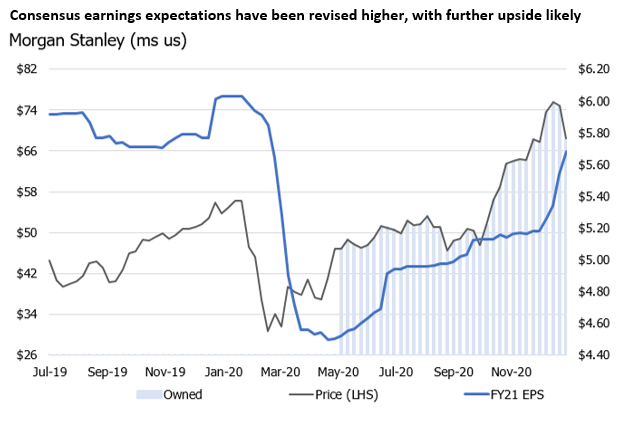

Strong capital returns and an underappreciated outlook for growth: Morgan Stanley is at an important inflection point – it now has a powerful platform in place to support a sustained acceleration in growth over the next several years. Capital returns (dividends and buybacks) will be >10% in 2021, with scope for further positive surprises given the extent of Group profitability and excess capital. We don’t believe that the current PE multiple of <12x reflects these strong fundamentals.

Author: Jeff Thomson, Portfolio Manager