Who: Johan Carlberg, Portfolio Manager

Where: USA – Texas

When: September 2016

What were we looking for?

I conducted four days of energy related meetings in Dallas and Houston. The goal was to review current industry conditions and the production outlook for 2017.

I met with majors (BP, Shell, BHP), large US shale producers (Range, Anadarko, EOG, Apache), services companies (CBI, Schlumberger, Halliburton), US LNG producers/projects (Cheniere, Texas LNG) and industry consultants.

What did you discover?

- Production is no longer falling

The steep production decline for so called unconventional (shale) oil that was forecast to balance the market, following the oil price crash in 2014, has come to a halt. Most producers we met with are planning to hold production at current levels or increase production next year.

- Costs of production has reduced dramatically

The costs to produce a barrel of oil has fallen significantly through improved technology and lower input costs. All the companies we met were confident that they can manage through at prices in the mid $40s. While many have retreated to their most productive areas, for many the Permian basin, they have sufficient reserves in these areas for several years.

- The expectation for the oil price is between $50-55 next year

Sentiment in the industry has improved markedly following the rebound from the global growth scare in January this year, when the oil price briefly fell to $26. Consensus is for an oil price around $50-55 in 2017. This is lower than six months ago as the price recovery has been pushed out. “Lower for longer” was an oft-repeated phrase. At $50-55 most would expect to ramp up production quickly. The collapse in the capital expenditure for higher cost offshore projects will eventually stabilise the market, but this will be a while away.

- Cash flow will dictate production volumes

Companies have learned to live within the cash flow they generate. With little desire or ability to increase debt levels, cash flow generated dictates production levels. While this limits production volumes at lower prices and increase in the oil price and thus cash flow will be reinvested in increased production levels.

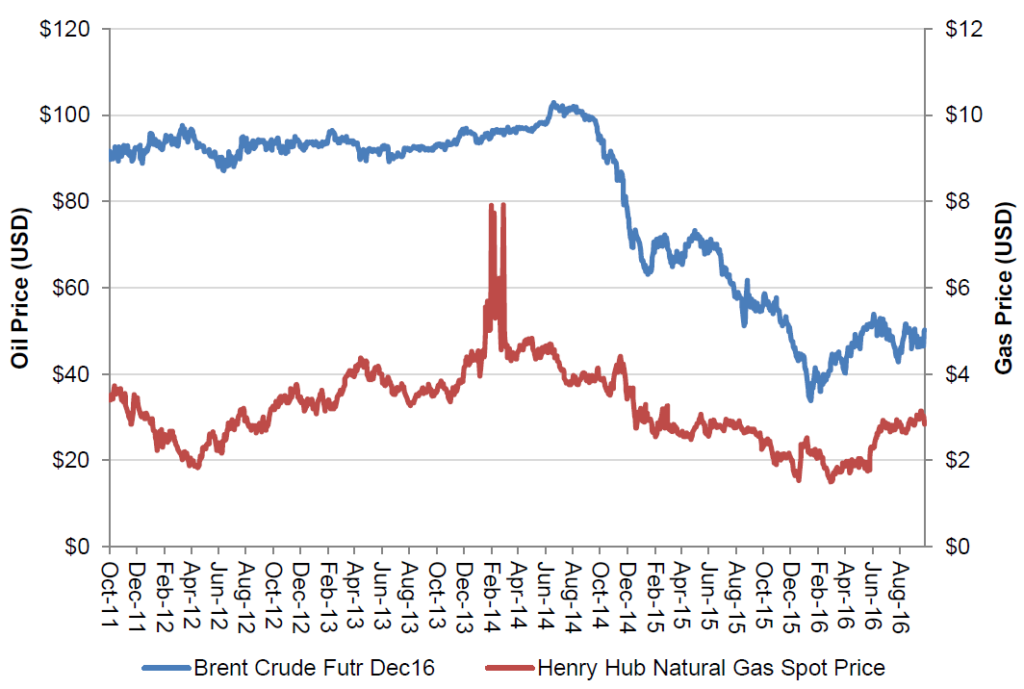

Figure 1: Five year movement of Brent Oil vs Gas Price (USD)

Source: Bloomberg

- Consolidation in the oil sector is happening

The higher quality operators with better balance sheets are making the most of the opportunity to acquire weaker competitors. Anadarko and EOG have both made attractive acquisitions. Bankruptcies in the sector have generally been in the smaller players, and are not having a large impact on production.

- The US LNG threat is real

With huge amounts of cheap gas and competitive construction costs, the US is likely to become a meaningful LNG exporter over time, likely to challenge prospective LNG projects in higher cost countries such as Australia. There are currently eight projects underway. The weak global LNG price is making funding of new projects, which require offtake agreements, challenging. However, US LNG projects will be very competitive in the future as domestic gas prices will stay low while the global LNG demand/supply situation improves. On a positive note, the fall in the price of LNG has seen increased demand from countries e.g. Colombia, India. This may rebalance the market more quickly than the general view of 2022-23.

- Coal is dying

At least that’s what everyone in the oil & gas industry believes. Gas will take over. There is no other alternative. Federal regulation, aging coal plants requiring meaningful maintenance capex and low gas prices will see a structural decline in US coal production.

- Unconventional oil & gas production difficult for conventional majors

It became increasingly clear from our meetings that unconventional operations require a different culture and management structure than is typical for the traditional oil companies. Unconventional requires a management structure where field area managers have a high degree of autonomy and can adjust production processes and drilling programs on short notice as they learn on a well by well basis. Of the majors, BP with unconventional assets, has recognised this and separated the management structures.

What does this mean for the Alphinity portfolio?

The portfolios have held an underweight position to oil and gas over the last couple of years, especially avoiding the companies with stretched balance sheets. This has benefitted the portfolios, though periods of improving sentiment towards the sector has made the returns volatile. We own Oil Search, as we believe this is the safest company in the sector with the most significant potential for long term production growth.

This trip confirmed that despite the lower oil price, production in the US is stabilising. As with any cyclical industry, the supply and demand will eventually rebalance and as always, geopolitical factors play an important and unpredictable role in determining the oil price. However, any meaningful oil price bounce (for instance if OPEC (Organisation of the Petroleum Exporting Countries) was successful in its attempts to get agreement around cut backs) would be met by increased production from US Shale players. Given dramatically reduced production costs and continuous improvement in production technologies, we expect the US oil & gas industry to place a ceiling on the oil price recovery. OPECs ability to dictate the oil price has been permanently impaired, in our view.