Over the last 12 months the Australian equity market has been supported by a strong cyclical earnings recovery, unprecedented fiscal support and an extraordinarily high level of liquidity in the global financial system. These supporting factors are progressively being priced in, removed, or becoming more fragile. Investors are again facing the time in the cycle that market participants refer to as a “stock pickers market”, when although a degree of caution is warranted, good opportunities also present themselves to differentiate. In this note we look past the post-COVID earnings peak and explore some of Alphinity’s high conviction positions still enjoying earnings upgrades.

Peaking earnings levels

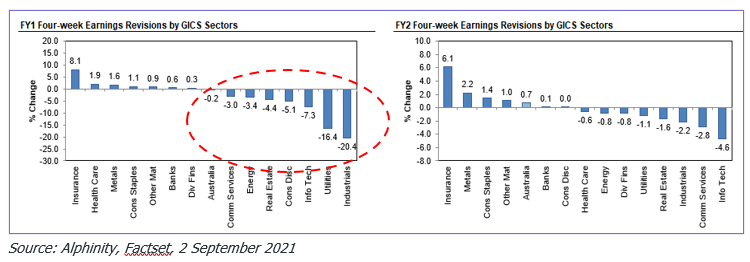

After the most rapid upgrade cycle in over 30 years, earnings revisions for the Australian share market have once again turned negative. Consensus expectations for both FY22 and FY23 have deteriorated over the last two months (inclusive of the full reporting season), coinciding with the Delta outbreak and extended lockdowns, indicating a decreasing confidence in a recovery continuing at the same pace into 2022.

ASX Earnings momentum rolling over

Positive earnings revisions in the last few months had already been increasingly narrowed into a handful of sectors which have been holding up the market averages, i.e. metals and mining and banks. With negative earnings momentum becoming evident across some other sectors as we moved through reporting season, the sectors currently exhibiting any material positive earnings momentum are Insurance, Metals, Consumer Staples and Other Materials. An aggressive move lower in iron ore prices in particular, slowing momentum in Banks’ earnings revisions, cautious consumer behaviour, and the extended lockdowns are all taking a toll and resetting expectations lower to a more normal 5-6% earnings growth for the current financial year, FY22.

Negative earnings revisions have been across many sectors

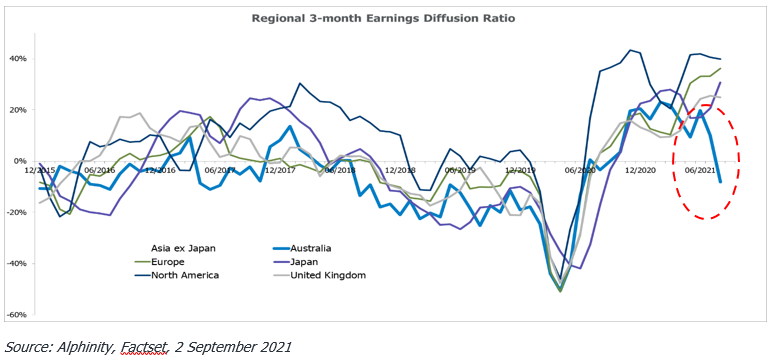

Our preferred measure of earnings sentiment – the number of positive versus negative revisions – has gone negative recently for the first time since the onset of COVID. All sectors apart from Financials are now experiencing more negative than positive revisions. While parts of Australia are still in lockdown, many other developed markets seem to be opening up which is causing a divergence in earnings sentiment. The majority of developed markets are still enjoying positive earnings sentiment, albeit at a lower rate.

Australian Earnings sentiment has also rolled over for the first time in a year

Less liquidity ahead

As inflation continues to surprise to the upside and global economic recoveries advance, developed market Central Bank rhetoric continues to point to scaling back their balance sheet policies. Balancing the risk of the recent rise in downside surprises, central banks are however also signalling that asset purchases will continue into next year and interest rate hikes are still some way off. Last week the RBA surprised the local market by reiterating plans to scale back its pace of Quantitative Easing despite ongoing lockdowns, but also announced it would delay the start of that process to February 2022 rather than November 2021.

Valuations not offering much support

The post-recession recovery in the market was largely initially driven by multiple expansion (the hope phase, exacerbated by collapse in interest rates), but this changed over the first half of the year as positive earnings revisions came through, justifying much of the rally. As a result the multiple of the ASX300 has fallen from ~25x to ~17x forward earnings.

At first glance a 17x multiple doesn’t appear too alarming, being only a little higher than the long term average of ~15x, however excluding resources the market is on a more sobering 22x, and excluding Resources and Financials it is on a decade-high 31x. While the multiple at which Resource-exposed companies are trading has now come down to ~9x forward earnings, these earnings are based on very high commodity prices, and the impact of recent falls in some commodity prices is still to be felt.

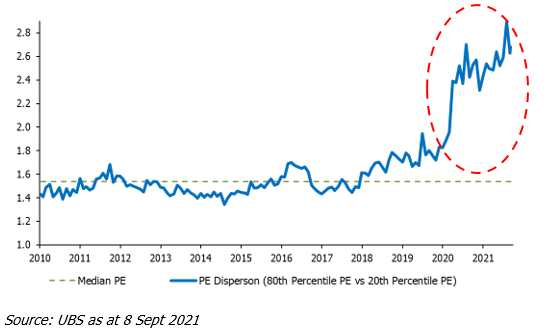

Another outcome has been a huge dispersion between high price-to-earnings (P/E) and low P/E stocks in the Australian market, leaving a part of the market particularly vulnerable to earnings misses or a change in macro environment.

ASX200 P/E dispersion (80th percentile/20th percentile)

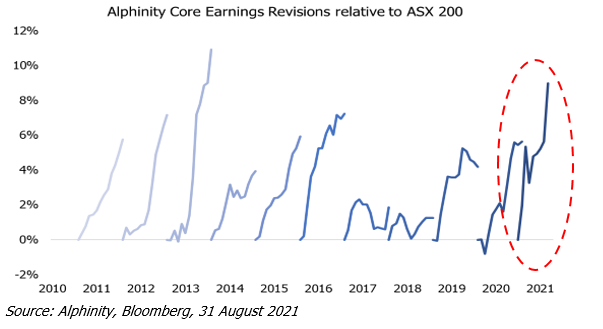

Picking stocks past the peak

The combination of maturing cyclical growth, lofty valuations in some parts of the market, an unpredictable bond market and more COVID strains have left companies and investors uncertain about the outlook ahead. After such a strong 18-month rally, it is time for Australian investors to look for companies still enjoying earnings upgrades, as multiple expansion is less likely to drive upside in the near term.

At Alphinity we invest in high quality stock-specific opportunities at reasonable valuations whose earnings upside is underestimated by the market. Over the last few months, we have taken the opportunity to tilt our portfolios towards individual companies at the right price with earnings upside, a combination of cyclical, defensive, and select growth names.

Alphinity: finding earnings upgrades ahead of the market

Our portfolios enjoyed a solid FY21 earnings season with earnings upgrades achieved across a range of sectors, including QBE (General insurance), James Hardie (Building Materials), Amcor (Paper & packaging), Medibank (Private health insurance), Reliance Worldwide (Industrials), Sonic Healthcare, Resmed (Healthcare), CBA and NAB (Banks), Domino’s Pizza and Super Retail Group (Consumer Discretionary).

Below we detail three high-conviction ideas for FY22.

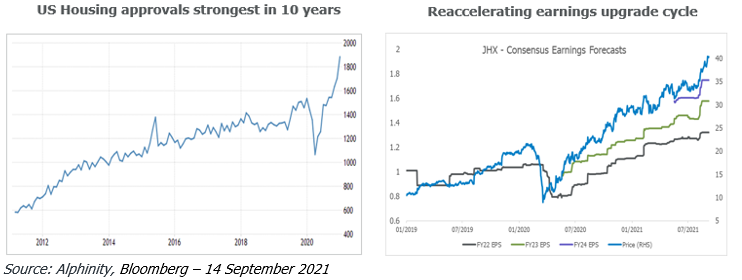

James Hardie (Building materials) – Leader in Fibre cement siding and interior products

James Hardie is a leader in Fibre cement siding and interior products in Australia and the US (the bulk of earnings). The company has been benefiting from the current environment of low interest rates, strong home prices and consumer working pattern shifts – all of which are supportive of large home repair/remodel projects. The company is uniquely positioned to capitalise on strong market conditions with new production capacity coming on at the same time competitors are capacity constrained. On pricing, James Hardie has shifted to a value-led strategy with the current tight market for building products supportive of this change allowing it to take material price increases. In addition, it is launching new products that will increase its total addressable market. Margins continue to surprise positively given both volume and pricing growth despite continued investment in future growth initiatives. Management recently raised medium-term targets across all geographies. Key risks include the US housing cycle and the potential for increasing US mortgage rates.

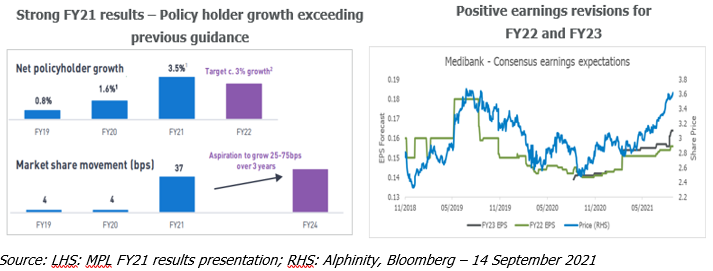

Medibank (Health Insurance) – Market share gains and ongoing reshaping of the claims curve.

Medibank is the largest private health insurance provider in Australia, covering 3.7m people through the Medibank and ahm brands. Medibank has become the best manager of claim costs in the industry through the use of its scale and data and has recently benefited from lower claims as a result of the COVID shutdowns. The company has taken conservative provisions for COVID and is now giving back to customers via lower prices/free coverage days, cementing its recent brand improvement and return to customer number growth. Medibank has big plans to grow its in-home care and become a more wholistic health business, which we believe is likely underappreciated over long term. Medibank is very well capitalised and is likely to put some gearing into the business, freeing up equity for capital management or acquisitions.

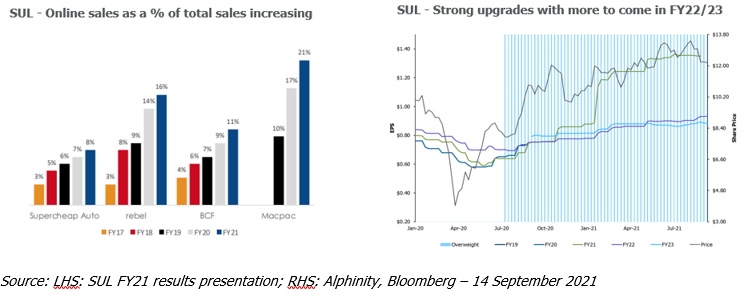

Super Retail Group (Consumer Discretionary) – Benefiting beyond COVID lockdowns

Super Retail Group operates several retail formats, including Supercheap Auto, BCF, Macpac, and Rebel Sport. All of these have benefited to some extent from the trends resulting from COVID: repairing cars, holidaying locally and increased exercising. The company has managed its inventory well despite many supply chain challenges and is well placed for a reopening of the economy later in the year. Cost management has also been good, benefiting somewhat from lower rent with many landlords under pressure. Super Retail’s strong capital position is allowing it to commit to 55-65% payout of earnings, retaining plenty to keep investing in the business. Its recently released FY21 results were ahead of market expectations and it has subsequently enjoyed earnings upgrades for FY22 and FY23; we see scope for further upgrades over the course of the year as better trading conditions and a strong online strategy more than offset any reopening pressure.

Author: Elfreda Jonker, Client Portfolio Manager

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.