Activision Blizzard is the largest US listed video gaming company, with revenues of around $7 billion and over 400 million monthly players across its titles. Its hit franchises include Call of Duty, World of Warcraft and Candy Crush – games which are even more popular today as fans are engaged by new content.

A big bet. Call of Duty is the largest franchise in the Activision Blizzard stable, first launched in 2003. The latest instalment, Call of Duty: Modern Warfare, is the 16th in the series and was released in October last year. The company makes money from players buying the game and from players purchasing passes and bundles to deck out their characters within the game. The bet, which had many critics, was releasing both a mobile version and a free-to-play ‘battle royale’ version which could cannibalise sales in the core franchise.

Management argued the opposite and they were right. Modern Warfare is the fastest selling instalment in the company’s history and in-game content sales have more than doubled. The free-to-play version, Warzone, has brought in 60 million players, enabling a new set of customers to experience Call of Duty and driving success across the franchise. Cleverly the platforms are linked, with game progress and items shared across games and platforms.

Social, yet socially distant. Most companies are seeing earning expectations fall at unprecedented levels due to the pandemic. In contrast this has been positive for video games, with engagement increasing as people shelter from the virus in their homes. Games are a great way to be entertained and socialise at the same time. Consumer budgets are under pressure as unemployment rises, but historically gaming has been resilient growing mid single-digits in the last two recessions. This time there are few alternatives as cinemas, concerts and sporting events may not be available for some time.

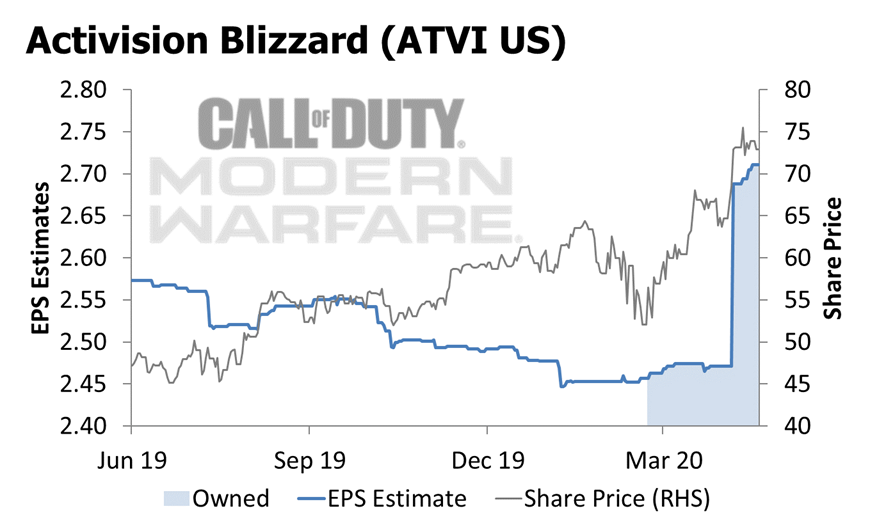

With the momentum improving in Activision’s franchises and increasing demand from sheltering, earnings estimates have increased substantially. The shares are up over 30% since we bought the stock, and we are optimistic about the company’s future with new content coming and the launch of the new Playstation and Xbox consoles later this year. Despite the pandemic we are still finding great companies with earnings that are more resilient and even improving.

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.