In the rapidly evolving world of socially conscious investing, it seems that sustainability has finally arrived. Whilst the integration of environmental, social and governance (ESG) factors into fund managers’ fundamental research processes has become mainstream in recent years, sustainable investing takes that approach one step further by also considering the impact a company has on society.

Sustainability is gaining traction with investors, but it is not without challenges. Typically, socially conscious strategies have only focused on negative filters, without taking into consideration the positive contribution a company might have on society; investment returns can be compromised due to constraining the investment universe; and data on companies’ ESG performance can be of variable quality, resulting in many arguable or ‘grey areas’.

The rise of sustainable investing

Research conducted by Responsible Investment Association Australasia (RIAA) in 2017 shows that nine-in-10 Australians think that sustainable investing is important. Furthermore, 63% of Australians expect their advisers to incorporate their values or at least consider the societal or environmental implications of certain investments. In particular it is Millennials who are leading the charge. One key attribute of Millennials, now aged in their 20s and 30s, is their stated desire to live lives consistent with the values they espouse. 84% of them say they want to invest in a socially responsible way and their influence will grow as they become older and richer [1].

International organisations such as the United Nations and European Union are encouraging corporates to generate company profits in a positive and sustainable manner. Many of the world’s leading companies now consider sustainability in their corporate strategies, including Coca-Cola, Apple, BMW, Adidas, and H&M.

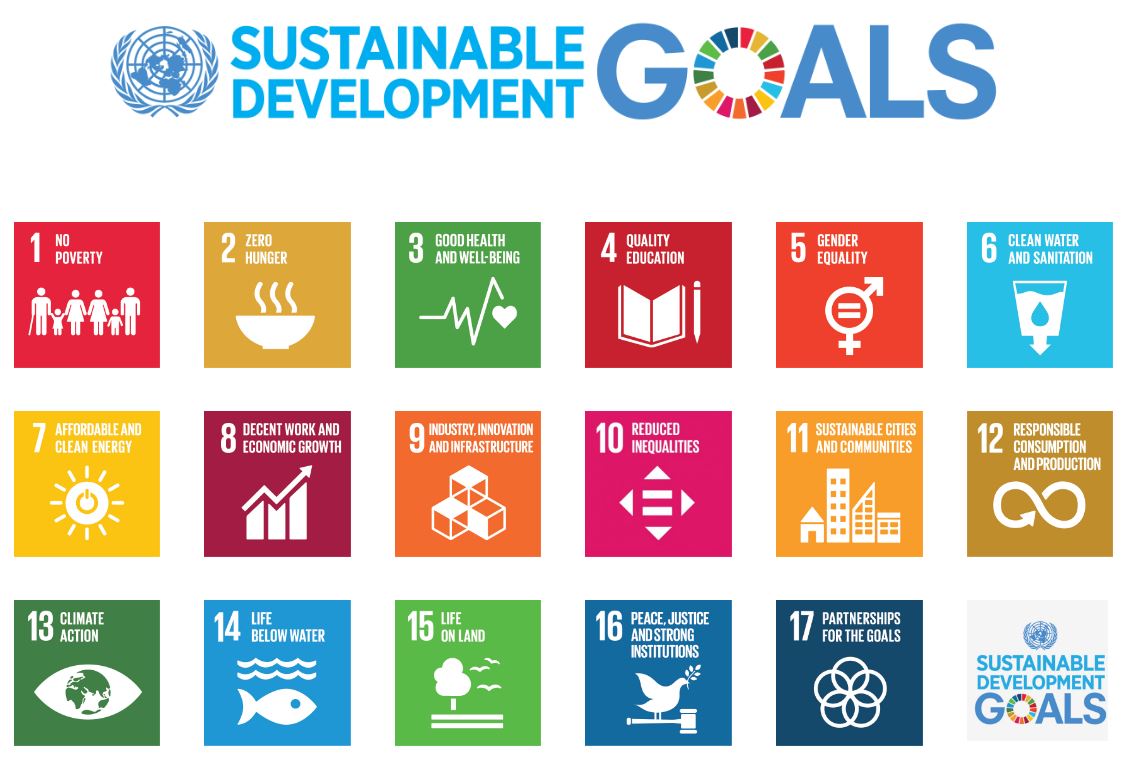

In 2015 the United Nations developed its Sustainable Development Goals Agenda (SDGs), a set of goals which, if achieved, would ‘end poverty, protect the planet and ensure prosperity for all’ by 2030. Broad and ambitious in scope, the SDG Agenda addresses the three dimensions of sustainable development: social, economic and environmental, as well as important aspects related to peace, justice and effective institutions [2]. These goals are shown below.

Assessing the extent to which a company’s operations and products support the Sustainable Development Goals agenda is an appealing way to address broader sustainability.

The investment manager as advocate

The investment industry is also evolving and, in some areas, driving the change. Simply having a “clean hands” approach is no longer good enough. Many existing socially conscious funds purely screen and exclude whole industries on the basis that they have a negative impact on society. This approach strictly reinforces a company’s adherence to ESG principles but fails to consider whether a company is contributing positively to society. We believe investment managers should also be playing an ‘advocacy’ role, by putting pressure on individual companies to improve their ESG performance. In turn this operational improvement can to lead to improved financial outcomes, along with the broader positive impact to society.

The dilemma for investment managers has been their fiduciary responsibility: their primary goal is generally to maximise returns for a targeted level of risk. In the past it has usually been assumed that pursuing both social good and profits would damage investment outcomes, as screening out potential investments or pursuing goals other than profit maximisation might result in the missing of opportunities. These are legitimate concerns and have often resulted in an unwillingness to commit to socially conscious investing.

However, investing sustainably doesn’t necessarily mean sacrificing potential returns.

Investing for good and for returns

The most common objection to investing with a social conscience is that an investor needs to sacrifice returns to invest for the greater good. An increasing body of evidence is beginning to challenge this view, and the outcomes achieved by some such funds suggest it is possible to have both. Industry research summarised by Willis Towers Watson in their paper ‘Show me the evidence’ confirms better ESG scoring companies tend to provide moderately better risk-adjusted returns over the long term. From the evidence collected to date, Governance (‘G’) and company engagement have proven to lead to a positive impact on returns. The evidence is likely to grow as more research is conducted.

A commonality across the research points to a heightened quality factor via a lower cost of capital which in turn leads better stock performance. Published University of Oxford research by Clark, Feiner and Viehs (2014) on over 190 sources showed 90% of the studies on the cost of capital demonstrate that sound sustainability standards lower the cost of capital for companies. 88% of that research showed solid ESG practices result in better operational performance of firms.

Alphinity agrees with Willis Towers Watson’s conclusion: “Astute long-term investors understand that ESG factors are not necessarily non-financially related factors, as is often perceived, but rather an additional source of insight into the risk and return profile of that investment.” Combining better scoring ESG companies is likely to become another pillar of active management, along with conviction, skill and a disciplined consistent approach. It has been a long road to this point, but sustainable investing has finally arrived.