Profit margins determine how much money a business is making and represent the overall financial health of your business. It shows how much every revenue dollar is flowing to the bottom line.

Investors are currently faced with more uncertainties than usual. The Federal Reserve has committed to hiking rates to address an acceleration in inflation, but at the same time, with a war in Ukraine and continued Covid disruptions in Asia, the downside risks to global growth have increased.

Against this backdrop, it’s no surprise that market volatility has recently spiked. Equity risk premiums have also increased, which has pressured valuations, especially within the more expensive and speculative areas of the market.

During such periods our attention remains focused on what we can analyse within the safety net of our tested process. In other words, we continue to be focused on investing in high-quality companies where we have conviction that they can deliver stronger than expected earnings despite these macro headwinds.

Below we reflect on the overall outlook for earnings growth, before looking in more detail at two examples of companies which currently fit our process. Danaher and OnSemi are two high-quality businesses which we expect will be able to protect or even grow their margins during this challenging period and deliver better than expected earnings growth.

Earnings increasingly at risk

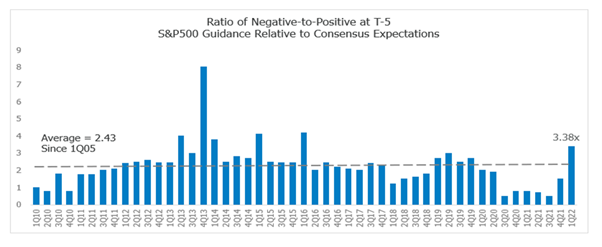

There was a hawklike focus by investors on company forward guidance during the recent reporting season as investors sought to find companies able to offer more certainty in a very uncertain world. The negative-to-positive guidance ratio for 1Q22 spiked to 3.4x, the highest since 1Q16 when the US was mired in a global manufacturing recession (see chart below). This has driven net earnings downgrades (-1.3%) for 1Q22, driven mainly by margins, with revenues largely unchanged. This is the first time revisions have turned negative since the post-Covid recovery started.

Increased corporate uncertainty – US companies guiding below expectations was 3.4x that of positive guidance during 4Q21 results season

Source: Bloomberg, MS Data

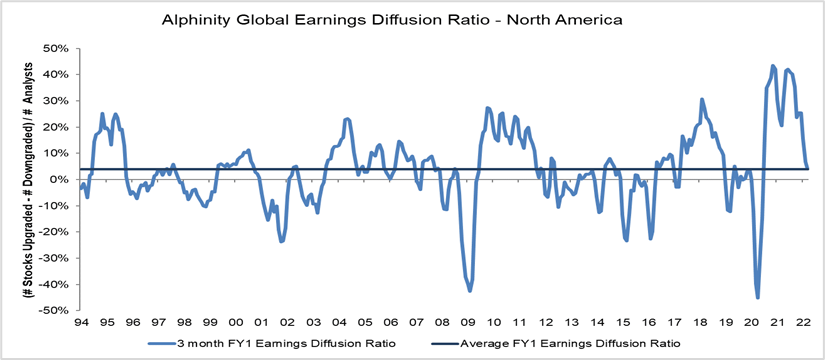

Overall earnings revision breadth (see Alphinity Global Earnings Diffusion Ratio below) peaked in August 2020 and is now decelerating fast and approaching negative territory, historically a signal for relatively more defensive market leadership.

Source: Alphinity, Factset

Margins the focus going forward

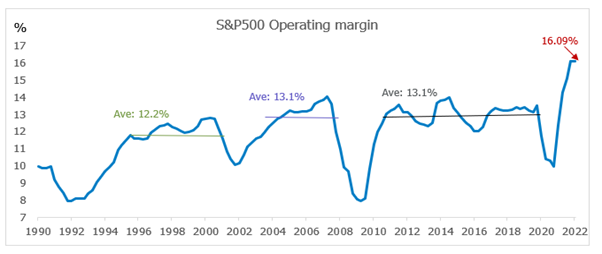

Margins were the main question mark in the recent quarterly results season, with US operating margins disappointing by around 200bps (non-financial stocks). Cost inflation and supply chain issues are key challenges across many industries, and there is also a growing number of companies experiencing a ‘give-back’ of earnings brought forward by Covid lockdowns, such as tech and consumer. The current Russian/Ukraine conflict will likely continue to add more inflationary pressures, which in turn could put greater value on margins and lower volatility of margins.

From a historical perspective, margins expectations are currently elevated with the S&P500 at new highs and the Nasdaq at the top of its post-GFC range, making any further signs of diminishing operational leverage a key factor to watch. Earnings downcycles can often start with analysts extrapolating margin expansion too far.

Margins are elevated relative to the most recent cycles

Source: Bloomberg

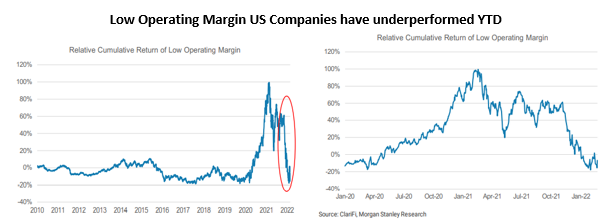

The market has already started to react to higher cost inflation and the risks to margins, with low operating margin companies underperforming year to date (see chart below). Nevertheless, we see further downside risks to earnings expectations from continued deceleration in revenue growth and negative operating leverage pressuring margins, making companies with solid and steady margins more valuable.

Source: Morgan Stanley Research

High-quality companies with resilient margins

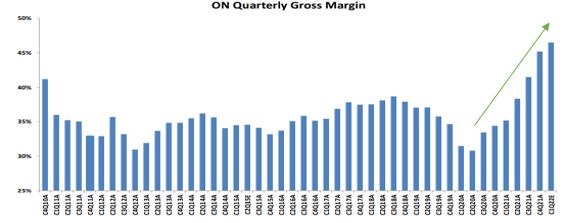

ON Semi – Guiding to record gross margins to come

ON Semiconductor Corporation (ON US) is a diversified semiconductor company focused on power and sensing solutions primarily targeted at the automotive and industrial markets. Some ON products also go to the PC, computing, consumer, and handset applications markets. In our view, ON is positioned for secular growth from power and sensing demand combined with strong returns driven by margin and ROIC improvements from self-help. In term of underlying market demand, the sector positioning around automotive and industrial is expected to drive top line growth at double the broader semi-conductor market while the continued reshaping of their product mix away from low margin, commoditised products towards higher value, differentiated products will drive continued margin expansion. ON outlined a gross margin target of 45% by 2025 at the 2021 investor day and achieved this well ahead of time in 4Q21. ON subsequently raised the margin target range to 48-50% as additional gains from manufacturing rationalisation and further improvements in business mix are still ahead.

New Gross margin guidance of 48-50% by 2025 represents a new record for the company

Source: Morgan Stanley Research

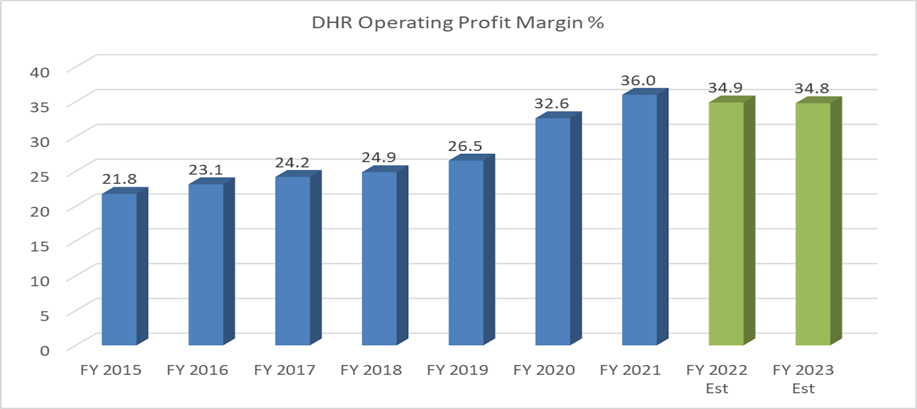

Danaher – Incredible pricing power

Danaher (DHR) is a global science and technology innovator that designs, manufactures and markets professional, medical, industrial and commercial products and services. DHR has a great portfolio of businesses exposed to structural demand growth across the Life Sciences and Diagnostics markets. It has a broad, global geographic exposure with 70% of revenues recurring and 70% being direct sales to end clients. DHR’s recent 4Q21 results and 2022/2023 guidance again underpinned the strength of their business and outlook for continuous operational improvement across their portfolio. DHR announced that they will begin including Covid-related vaccine and therapeutic revenues with core revenue due to their confidence in the durability as we move eventually into the endemic phase. Management’s investing competency with one of the best M&A track records in the sector is another important driver of above-average future earnings growth. The combination of ongoing earnings upgrades and a more reasonable valuation of 27x PE (forward) makes us comfortable with this quality compounder.

DHR – Track record of continued margin expansion

Source: Bloomberg

Author: Elfreda Jonker, Client Portfolio Manager