The Alphinity Sustainable Share Fund and Global Sustainable Equity Fund both invest in companies we have found to be doing good for society and the environment (by helping to address the UN’s Sustainable Development Goals [SDGs]) and are doing it well (in having strong Environment, Social and Governance [ESG] practices). We believe that in order to be part of the solution towards long-term sustainable growth, one cannot do it silently. Fund managers need to have a well-structured active engagement strategy in order to influence and drive both positive change and shareholder returns.

Stewardship responsibilities increasing

Investor demand for Sustainable Investing is accelerating and many financial market participants (asset managers, pension funds, insurers, commercial and central banks) are mobilising to align the financial system with the goals of the Paris Agreement and the SDGs. According to recent research by Credit Suisse, it is likely that Sustainable Investment assets will grow from $31 trillion in 2018 to more than $100 trillion in coming years purely as a result of current Principles for Responsible Investment (PRI) signatories’ commitments to move towards Sustainable Investing over time.

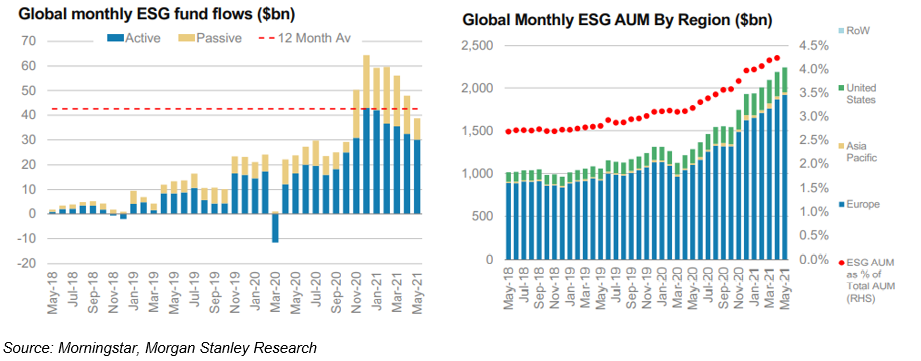

After many years of foundational efforts to standardise and enable Sustainable Investing, the current pandemic has focused investors on the vulnerability and resilience of the financial system and intensified the discussions around sustainability. Covid-19 has reinforced the importance of addressing global issues including pandemics, climate change and modern slavery to name a few, in global collaborative efforts. The external threat of a pandemic raised our collective consciousness about the need for society to change. According to Morningstar, around the world responsible funds (defined as funds focusing on sustainability impact, or environmental, social and governance factors in its prospectus or other regulatory filings, across equities and fixed income) attracted inflows of $US43bn on average per month over the year to the end of May 2021, almost four times the average in 2019, accounting for around 25% of total equity and fixed income fund flows over this period. Passive ESG funds initially accounted for 15% of these flows, and that proportion increased to around 30% after the launch of a number of new ESG Exchange Traded Funds (ETFs) over the two years to May 2021. Recent inflows have however been more skewed towards active funds, as the chart below shows.

In theory, all this interest in responsible investing should be a positive development as more capital is channelled into helping resolve some of the world’s greatest challenges. However, this is not necessarily the case as not all responsible investment funds are created equally. Just being named or categorised as “responsible” doesn’t make a fund so.

Not all Sustainable funds are created equally – Active vs Passive

By investing sustainably, we believe investors are aiming to achieve three distinct objectives:

- to invest in companies that contribute positively to society and/or the environment and not in companies doing the opposite

- to influence company strategies and practices so that they, and their broader industries, become (even) more sustainable

- to generate good investment returns.

In our view, only active management and engagement can properly achieve all three objectives.

1. Actively Assessing ESG performance. In order to invest in companies that contribute positively to society and have strong ESG practices one needs to understand the details of what those ESG practices actually are, and what the company’s net contribution to society is. It’s also important to hear the story behind external reporting, understand what companies define as material, and what they are doing to improve relevant risks and opportunities.

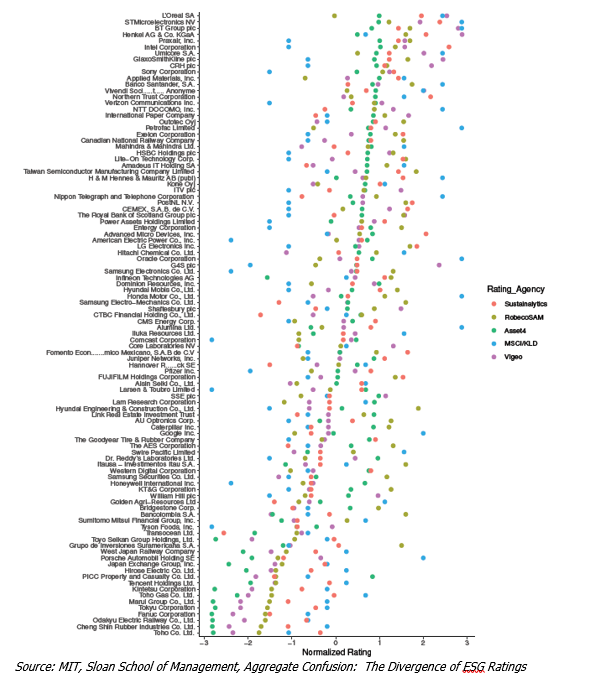

Passive investing typically uses third party quantitative ESG data that excludes some companies altogether on the basis of the third party’s conclusion and/or tilts a portfolio towards companies with higher ESG scores. The chart below, from a global study comparing the views of several major ESG ratings houses conducted by MIT Sloan School of Management in the US, demonstrates the challenge: there is little agreement about what good ESG looks like. Much of the analysis is subjective and there is no standardisation between the different providers either in the source data they use or overall scoring methodology they employ. For example, US electric vehicle maker Tesla is currently rated as having poor ESG characteristics by S&P, while another, Sustainalytics, gives it a “High-Risk” score. A third, MSCI, says it has quite good ESG, with an “A” rating.

To be fair, it is a difficult task to come up with well-informed views on many thousands of companies, as these organisations need to do. It is much more achievable to arrive at high quality conclusions when only you have 20 to 50 companies to do that with, as is typical for an actively managed portfolio.

However, a passive fund which uses the “wrong” research provider might end up investing in companies diametrically opposed to what you, as an investor, actually want to achieve, and diametrically opposed to your own ethos.

We use external ESG research and find it to be very helpful as a first step in determining a sustainable investable universe but placing too much reliance on it can be dangerous in our view. We too often find that the assessments are out of date or have simply been arrived at by looking at company-produced reports and ticking boxes rather than engaging with companies to assess their real operating practices and/or debating the many grey areas with them. There is also often limited assessment by research providers of the net contribution company activities provide to society – an important factor in our view.

Not engaging in direct dialogue with companies, and therefore not closely scrutinising them, could also mean missing out on opportunities to invest in companies which might not display their sustainability credentials very well but in fact do have strong practices. Some medium and smaller companies just don’t have the resources to put together comprehensive ESG and Sustainability reports or respond to voluminous external requests for information – but that doesn’t necessarily mean what they’re doing is not good.

Our experience is that it is critical to bring the final determination of ESG risk and opportunities in-house, where a team of experts can review practices and actively engage with the company’s management to derive our own qualitative assessment of current practices and changes taking place. In Alphinity’s case, this would address questions such as: are the products and services of this company really making a valuable contribution to society and the environment? How is sustainability governance established and what do the reporting and responsibility lines look like for ESG? Is this company really trying to improve its sustainability approach or is it just greenwashing? Is this company able to navigate sustainability challenges and changes ahead? Is ESG and sustainability part of its ethos? Are its ESG related targets reasonable, achievable, and supported by clear strategies?

Several years ago, Alphinity established a Sustainable Share Fund Compliance Committee which includes two highly reputable independent external experts who rigorously review the ESG and Sustainability assessments of companies within the Funds and decide on whether a company should be included in the Fund’s investment universe. The Committee ensures that the Funds remains true to their Charters, only investing in companies that have strong ESG practices and contribute positively towards one or more of the 17 Sustainable Development Goals.

2. Engaging with management to influence positive change. One of the key functions of active equity managers is to allocate capital to companies. This is something passive funds do the opposite of — they allocate capital to companies that are in whichever benchmark is being tracked and generally do so on the basis of the current size of the companies in that benchmark.

A key aim of Sustainable Investing is to influence companies’ strategies and practices so that they continually improve across all ESG and Sustainability aspects, and most importantly manage away any significant ESG risks. A strong voice with CEOs, Chairpersons and Heads of Sustainability is therefore critical to drive that influence. While there might be some exceptions, the engagement level of passive funds is typically low as they generally operate with few staff and their focus is limited by the very large number of companies in their portfolios, as they have to own most of the market or a whole of an index. Engagement may not be undertaken at all or might be outsourced to external groups rather than conducted by internal analysts or ESG teams with detailed knowledge of the companies and their associated ESG risks and opportunities.

On the other hand, active investors hold a limited number of positions, have more capacity to build relationships with company management teams, have detailed conversations with CEOs and Chairs about key ESG issues, explore their records, activities and policies, and help influence the evolution of corporate policies and practices with increased disclosures.

Proxy voting, the process whereby ballots are cast on behalf of investors at company shareholder meetings, is another important component of active engagement. Recent Morningstar research from the US found that active investors are more likely to hold management to account by voting against them on proxy ballots whereas passive investors are more likely to vote in line with management, or at best blindly follow a proxy advisors’ recommendation. The PRI, which is the world’s premier collaborative investor group, identifies shareholder engagement as a key fiduciary responsibility of investors.

“Our results place most emphasis on the deeply relational dimension of engagement, and invite engagement practitioners (companies, investors and the PRI) to consider engagement not only as a relationship that allows for ESG issues to be collectively discussed and addressed, but also as a space within which communication, knowledge, and power, flow in ways that create (potentially) unintended benefits on the investor as well as on the corporate side.” PRI report: How ESG engagement creates value for investors and companies

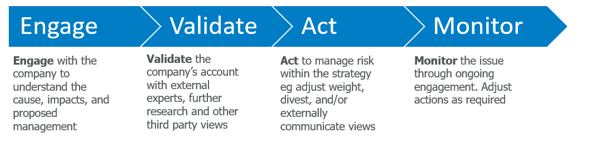

Significant and irreconcilable ESG-related controversies might from time to time warrant divestment from certain companies in circumstances where engagement has been unsuccessful. In such cases active managers can decide to sell out of that company, whereas passive funds generally do not have this option if the company remains in the index it is tracking. When faced with a significant controversy with a company in our portfolios, Alphinity generally follows a simple and structured process:

Many other active managers would have practices along similar lines. At Alphinity, our engagements with investee companies are generally either informative (i.e. conducted to clarify and better understand a situation or a practice) or purpose-driven (i.e. conducted to influence a change of practice or policy, or to seek a certain outcome). Those engagements are mostly conducted individually but are at times we will collaborate with investor groups if we feel it is more appropriate or likely to be more effective.

Over the past financial year, we have engaged with companies on more than 90 occasions, domestically and globally, on specific ESG and sustainability topics. We are proud to have been associated with driving change at Rio Tinto on the back of the Juukan Cave disaster, with CSL’s decision to undertake donor impact assessment around their collection centres in the US, with Bluescope Steel’s commitment to the 40:40 Vision, and with Oz Minerals’ broader commitments around Net Zero. Our engagements have encompassed matters such as decarbonisation commitments, strategy and target setting, modern slavery reviews, heritage management practices, employee culture, and governance. We are also pleased to have managed to help convince at least five companies to join the 40:40 Vision which seeks to improve gender diversity in companies’ executive teams.

3. Investing in companies with good return prospects. Passive funds, by definition, invest according to an index and do not take views on individual companies’ potential to outperform. Active funds on the other hand only invest in companies in which the manager’s fundamental research suggests is likely to generate better than market returns. It builds a portfolio based on the individual stock conviction and the macro environment the market is navigating. Many Australian active managers have a good record of outperforming benchmarks, after fees, over long periods.

It’s important to note that a company having good ESG practices and/or contributing positively to society does not necessarily make it a good investment. Some excellent ESG and SDG companies have, for instance, been very poor investments. In our experience stock selection within a well-defined and reviewed Sustainable Investment universe is critical.

Alphinity applies to its Australian and Global Sustainable Funds the same proven investment philosophy and process that has been used since 2010 for all our funds. We look for quality, undervalued companies undergoing a positive earnings revision cycle. This very focused approach has enabled us to deliver strong returns for our clients from investing in companies that do good for society (help attain SDGs) and do it well (have strong ESG practices). We do note of course that past performance is not a guarantee of future returns.

Conclusion

Active equity managers have an important role to play, a role that passive or index investors are not well equipped for. We are able to have more intense relationships with the companies we’ve invested in which can give us much better insight into their true activities than external research reports. We are better able to hold companies to account and help drive them towards better outcomes. We are also able to allocate our clients’ capital only to the companies we judge to be good investments and can avoid those with poor practices and/or prospects, rather than having to own everything in a particular index.

Putting this all together, we conclude that active management is the most effective way to achieve Sustainable Investment.

Find out more

For more information, please contact your financial adviser or call the Fidante Partners Investor Services team on +61 13 51 53.

Author: Elfreda Jonker, Client Portfolio Manager

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity), the investment manager of Alphinity Sustainable Share Fund and Alphinity Global Sustainable Equity Fund – Active ETF (Funds), for wholesale investors only. Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Fund(s). Other than information which is identified as sourced from Fidante in relation to the Fund, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. Investors should consider whether the information is suitable to their circumstances. The Product Disclosure Statement and Target Market Determination available at www.fidante.com should be considered before making an investment decision. To the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance on this information. Past performance is not a reliable indicator of future performance. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.